I’m Suzanne Dove, Assistant Dean for Academic Innovations at the Wisconsin School of Business and I’d like welcome you all here this evening, thanks for coming. So this is a collaborative event between the B-School, the Business School, and the UW-Madison Center for the Humanities. So before we get started I wanna make sure that we thank and acknowledge our sponsor, our sponsor is that National Endowment for the Humanities, and they have provided the funding that made it possible for us to hold this event. The Humanities Connections Program is intended to foster conversation and dialogue between humanities and professional programs including business education. So with that I’m going to turn to our speaker. Professor Mihir Desai is a Professor of Finance at Harvard Business School, he’s also a law professor at Harvard Law School and he’s going to talk tonight about something that has nothing to do with his area of research and scholarship. He’s gonna talk about his book, “The Wisdom of Finance: Discovering Humanity in a World of Risk and Return.” And so he’s gonna share a little bit about his experiences, and thoughts, and insights, from the process of writing that book. So please join me in welcoming Professor Mihir Desai. [crowd applauds]

– Thanks so much, it’s such a pleasure to be here and thank you for that introduction Suzanne. I’m happy to be here for many reasons, most of all it’s wonderful to be speaking to a group that already appreciates the connections in some ways between business and the humanities. I think personally you’re on the cutting-edge of the way people should be thinking about the world and I came to this late in some way, I stumbled upon it, but I really appreciate the opportunity share some ideas with you given your already deep understanding of these things. So I’m gonna not talk for more than 30 minutes and will hope to make a Q & A after that, so make it as conversational as possible. So, I’ll just begin with the title which is “The Wisdom of Finance: Discovering Humanity in the World of Risk and Return.” So when I told my publisher I wanted to title the book The Wisdom of Finance, he said, “You know, it’s good to be provocative but oxymorons don’t work,” which is just a way of saying nobody puts those two words together. And I said, “That’s exactly the point.” That is exactly the point and that is why I wanted title it the Wisdom of Finance. So what is this project about and how do I think about it? So it helps just to think about where it came from and I should just say that I am particularly delighted ’cause I have a former student in the room, and this book came out of efforts with students. And so sometimes you might not know, the students in the room, how much you give us, but it happens in many, many different ways. So, it’s about two years ago, we had these kinds of last lectures before students go off into the world, we’re supposed to give them a talk as a new tradition at HBS, and I was gonna give a talk about things going on corporate finance, the title was Slow-Motion LBO of America, it was about share buybacks, it was pretty hard-core finance and I was told that was not what I was supposed to be talking about. I was supposed to be distilling wisdom.

So I come up with the title, which is The Wisdom of Finance by combining the fact that I was supposed to be talking about wisdom and I know something about finance. Having given that title I had to figure out what it meant, which is what often happens in my life, you make a commitment then you try to figure out how to make it happen. In this case it was surprisingly easy, because I came to realize that these two seemingly disparate things; you have how we think about our life and how we think about finance are deeply connected and in retrospect there’s no surprise, which is finance is about how we create value and measure value in the world. That’s fundamentally what it’s about. That also happens to be question that preoccupies many of us with our lives, which is how are we creating value and if so how, and how can I create more value in my life. So at that very high-level it should be very clear that we’re talking about things that are quite related. As I was waking up every morning in a panic about what this talk was gonna be about, you know ideas would kind of stream into my head, and it was surprisingly easy to see that correspondence. So I gave that talk and it was just enormous amounts of fun including the GMP 18 Group, and it was just a spectacular experience. In particular, I’ll share one anecdote about that which is after I gave the talk a student from one of the programs I was teaching in, whose name I’ll never forget, Andreas Antonius, wrote me an email. It was a very nice email he gave me some feedback about the talk and at the end of the email he said, “It would be a crime if you do not turn this into a book. And I made the mistake of sending that to my wife. Who ended up printing it out and pasting it on my bathroom mirror, and so I woke up every day for a year and a half through the words of my student saying you have to make this into a book, which as far as I can tell is the only way this book would have gotten written and that’s part of what we get from you as students, for those of you who are in the room who are students. So then I had to figure out what the heck it meant to write a book; I’m a pretty truthful economist. I work on empirical methods in public finance, in corporate finance, and so the question what does it mean to write a trade book? And I thought you could write down your talk and get it published, turns out that’s not right. A book is different than a talk and some people can get away with that by the way, but I didn’t want to get away with it and I wanted to kind of figure out write this story in a bigger, and maybe bolder way, and sustain a listener and a reader over a longer period, not just half an hour, that is when I did the best thing I did during this whole process, and part of the fun of hopefully coming to a talk is hopefully you hear a little bit about the backstory. The best thing I ever did in this process which is I cold emailed a writer from The New Yorker who I had grown to really enjoy. I didn’t know him; I just cold emailed him and I said this is kind of what I’m thinking about, I really enjoyed his writing, he’s a young guy, and he responded, and we had lunch. And it was like a five-hour lunch. And we had four five-hour lunches and it was great. And he re-taught me the value of stories. And that’s what I needed ’cause as an economist we become distrustful of stories, because it’s N of one, you can’t understand anything from N of one obviously, says an economist, except people organize their thinking with stories and so if I’m gonna try to translate this into people’s lives I’m gonna need stories. And that’s where it became clear that the humanities were gonna be the way to articulate this connection in a deeper way.

So, what’s it about? Well, let me be clear what it’s not about. If you want to get nudged into saving more, or pick stocks, or anything like that, this is the wrong talk, I’m happy to talk about those things but perhaps at another time; what I’m here to talk about is actually reminiscent of what C.P. Snow was very worried about 50, 60 years ago. He was really a remarkable man. He wrote a book coming out of a talk called Two Cultures. He’s a real renaissance man, really wonderful, and he was both a scientist and a politician, but also won The Booker Prize, it was just this crazy guy. And he wrote this lecture about how the sciences and the humanities were getting divorced from each other and how that was a complete loss to both sides, and from my perspective that was completely analogous to what is going on with finance and the rest of the academy frankly, humanities but also the rest of the academy. And so what do I mean by that? Well at a first approximation many people in the humanities look at finance with derision; many people in finance look at the humanities with condescension. So, it’s not a good situation, I think. And so the loss mutual and finance I think is too important and the humanities are too important in our lives for them not to be talking to each other. This obviously is the premise and something Suzanne figured out a while ago, and I really wanted to try to address that gap. So and specifically the humanities I think will end up de-mystifying finance hopefully for people. That’s just a way of saying finance is not well understood. People find it intimidating and there’s a good reason they find it intimidating because people in finance like to intimidate people, it’s kind of what they do. And as a consequence finance is quite mysterious and often gets demonized by people who don’t understand. And so the first thing that we have to do is we have to de-mystify it so that people can come in, and enjoy it and think about it. So the problem with that is usually the way we talk about finance is with graphs and stochastic calculus and that doesn’t work for most people. And so we have to talk about it in a different way and it turns out the humanities are a wonderful way to talk about these ideas; the second thing is actually I think finance and this will ultimately become clear can help you think about your life and I think also in an interesting way. And I’ll try to make that more clear in a sec but that’s fundamentally what I’m doing. I like this quote very much, its, “Money is a kind of poetry.” It’s the epigram to the book. It’s Wallace Stevens. If you don’t know who Wallace Stevens is you might think he’s some Gordon Gecko Wall Street guy who worships money, he’s not. Wallace Stevens is arguably the greatest poet of the last century at least in my estimation, American poet. And he also loved poetry and he loved insurance, which may come as a shock, came as a shock to me; I didn’t fully appreciate this. Wallace Stevens spent his career in insurance and he loved it, and all the other poets made fun of him. So John Berryman called him a money man, very bourgeois, not a real artist, ’cause he was working in insurance. And he never wanted to give up insurance, and in fact Harvard offered him The Charles Eliot Norton Professorship of Poetry, and he said no, because he wanted to keep working at the Hartford. This doesn’t happen every day. It’s kind of an unusual circumstance. He loved insurance and the reason he loves it and he made this clear in some of his prose is because insurance and poetry were not disconnected in his mind. Things that you might think of as totally disparate were totally connected in his mind, ’cause he understood both and he understood both deeply and that’s in some sense the connection I’m trying to draw more generally.

So hopefully if you’re outside the world of finance you can come on in and you’ll come to love it as those of us in finance do love the underlying ideas. More ambitiously, I think it’s hard to be somebody in finance today, because what you do is looked down on and is vaguely considered evil. In that kind of equilibrium people have very low expectations for your behavior, and the equilibrium we’re in is people look down on finance, people expect very little of it, and there’s a very low bar for behavior, and as surprisingly people don’t behave terribly well. That’s a bad equilibrium. We should be aspirational about what we do in finance. We should not be looking down at our shoes when we talk about it, we should understand that there is nobility in it and that hopefully will also lead to better behavior, ’cause you understand the nobility of what you’re doing. Said another way, you gotta get out of the spreadsheets and the screens to understand what you’re doing, and I think a little bit more powerful way to think about what you are doing. And then finally the really big payoff, hopefully, is we make finance better; so I think finance is broken, big chunks of it are broken, and you know by that I mean there’s more value extraction going on than value creation. I think that’s evident in many ways, we can talk about that later if you want, but there are real problems and should admit it and understand it, so how are we gonna make it better? So the two candidate solutions are regulation and outrage. So outrage is occupy, and maybe that will make you feel better but I don’t know if it’s gonna change things terribly much. Regulation I think is worthy and we should do more of it in many ways, but we also know that it has a number of counterproductive consequences and unintended consequences and we know that a lot of regulators are captured, so we shouldn’t expect terribly much I don’t think. So what’s the idea here? Which is let’s get the people in finance and let’s get the next generation of people in finance anchored in the ideas and the ideals of finance and hopefully they behave better. You know that might sound naive or Panglossian; I don’t think that’s gonna work tomorrow or in my lifetime, but it’s gonna be the way this gets resolved. Ultimately that is the only way it’s gonna get resolved I think. So we wanna re-anchor the practices of finance in ideas. All right, so let me take you through this next thing and then we’ll dive in more formally. This slide will maybe horrify you but let’s just try it out. So this looks like the table of contents for every kind of finance that you might open up, which is it starts with the risk and insurance, that’s the fundamental thing; we were talking earlier about how during the process of writing this book I had to really re-investigate the core ideas, in a different way and I just came to appreciate how everything is about insurance.

It’s really all about insurance. It’s amazing how important insurance is to all of these ideas. So starting with risk, we have to think about risk and insurance, then we have to think about having introduce risk, how do you manage it, that’s derivatives, that’s options, that’s diversification for those of you that are in finance that’s the Capital Asset Pricing Model. It’s a whole, rich set of ideas. From there we go to this idea of value, where does it come from, how do I recognize it. How do I know if it’s being created? So this central question in finance and in fact those three things for those of who are in finance from an academic perspective, that’s asset pricing. How is risk priced? How do we think about why systematic risk might be priced, What are expected returns? How do we think about all those questions? Then we go, for those of you who are academics in room in finance, we go to corporate finance. We introduce firms, it turns out life is not a disembodied set of investors and claims in the world. There are these things called companies and we have to understand how they behave too. And so that’s about corporate governance. I’ll come back and talk about why I think that’s the most important problem in modern capitalism. We go to mergers, firms merge, what’s the boundary of the firm, we think about leverage, which is this great idea in finance that people love to talk about, and then end where people sometimes end which is bankruptcy. And that’s really meant to be a table of contents of a textbook, it also happens to be the intellectual spine of my book. I would never label it that way ’cause nobody would read it, if I did, but underneath it all there’s a structure there, which is those run through in some deep way. So that’s roughly what the book tries to do. The last chapter is provocatively titled: Why Everybody Hates Finance?, which meant to say I just told you how wonderful and how noble it is, and yet we live in a world where people are really upset about it. How do you understand that? And I’ll try to take you through that. I’ll mention one other story as the backdrop for this which is as academics, we’re used to kind of, you know criticizing each other’s work, it’s like a pretty rough and tumble field, certainly economics and finance is, and you go to seminar and people beat you up, and you beat them up and it’s all for the greater good. But when you publish your book it’s different and it’s public and it was a really interesting experience for me; so I’ll just share this little story which is, I was very fortunate I got a lot of nice reviews and everything, and then I got a little paragraph, in The New Yorker and it was like this big. It was like briefly noted, or something like that and my friends were like this is great, this is fantastic. And then I read it, and it was, it said the following basically. The first three sentences were very nice, blah, blah, blah, and then the last sentence was, but, “he never answers the most important question of all, which is the title of his last chapter.” And that was like a knife through my heart. And you don’t get a chance to say you know, that’s the next book.

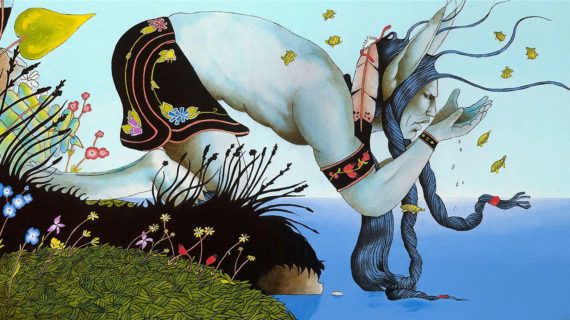

You never get that chance, but that was kind of one of those things that happens; I’ll give you a short-version of that so you can get a sense of what I mean by that. t say is there are two things I’m most proud of this book about: the first is the references section, when you write a book like this you have to sacrifice a lot of scholarly instincts, no footnotes, you have to be little rough and ready with the ideas and so the references section makes up for all that; it compensates for all the looseness in the chapters and hopefully gives you a lot of leads if you wanna know more and also just makes me feel less guilty about what I did during those chapters. The second thing I’m most proud of is every chapter begins with a picture and I had to fight like heck to get my publisher to put pictures in the book. So what I thought I could do is as we go through this, I’ll show you some of the pictures and if you can name the picture, I’ll send you a book. Okay. Maybe we’ll have a little fun and we can give away a few books. I have to tell you in advance it’s not terribly easy. But I have faith in you. The first one is too hard I think, the first one is the Goddess Fortuna, and this of course is the way we thought about probabilities until 300 years ago, which it was the wheel of fortune, and there she is holding the wheel of fortune, the original wheel of fortune that is. And that’s a way of saying we had a really hard time understanding risk and randomness for a long time and we chalked up every outcome to the Goddess Fortuna. So finance is some basic sense is all about how we think about risk and randomness, and how we live with it. So rather than tell you that through a utility maximization problem over time, I’m gonna try to tell it to you with a story, it’s called the Flitcraft Parable. It’s from the Maltese Falcon by Dashiell Hammett, which is like a mystery novel and it features Sam Spade, who’s this kind of hard-scrabble detective, and here’s the story, and it’s considered I think the most important story in Hammett’s work, and by the way it’s a John Huston starring a very young Humphrey Bogart, it’s awesome, I suggest you rent it. So here’s the story: Sam Spade turns to this woman who is his love interest and also his prime suspect, because that’s the way Sam Spade rolls, And he says I wanna tell you this story about Flitcraft. And so, she says okay, and says, you know I gotta call from this woman in San Francisco and she said, “I want you to take this case, my husband disappeared five years ago, he went out in the morning, and he never came back.” No money problems. No family problems. He just disappeared. I just got a call from somebody in Spokane, Washington who says they just say him. Sam, I want you to go to Spokane, find this guy, see if he’s my husband Flitcraft. Sam takes the case, he goes straight to Spokane, Washington, relatively easily he finds the guy. He says, “Are you Flitcraft?” The guy says, “Yes, I’m Flitcraft.” And Sam says, “What happened?” And by the way he’s now going by the name Charles Pierce. And you know Sam says, “What happened?” And Flitcraft is actually relived to finally unburden himself of this story. So he says, “I’ll tell you what happened. I went out in the morning and I was going on the way to lunch and as I was walking along a construction beam, a big iron beam fell, right next to me, right next to me, and in fact a piece of the sidewalk flew up in my face and gave me this scar.” And at that moment I realized that the world was random, and I had been living my life as if it was well-ordered, and I’m out of sync with the Universe. And so I am going to change my life at random.

And so he changed his life at random, and he left, and he never came back. By the way when I tell my wife I’m gonna start the book with this story she’s not impressed. But then Sam says, “But my favorite part of the story is when I found him in Spokane, he had re-created the same life he had in San Francisco. He was married, similar wife, similar home, kids, job, the same thing.” So what’s the lesson of that story? So the lesson of that story is kind of buried by Hammett who was a private detective in the names Flitcraft and Charles Peirce. Flitcraft was the most important actuary at the turn of the last century. And Charles Peirce is a philosopher who is obsessed with insurance. That story is about insurance in many ways. So what is the fundamental problem in life? There’s randomness everywhere. It’s a fundamental problem in finance. How do you navigate it? How do you figure it out? And the answer is: you look for the patterns. Because what looks random is in fact not random. Things in the world look random but in fact they behave vary regularly. This was the discovery of 19th and 18th centuries in probability, things that look random actually behave incredibly, with some great regularity. That is the foundation of finance. The way you think about these problems, random things, stock price movements, whatever you wanna think about, actually behave in systematic ways, and that’s the foundation of finance. It’s also the foundation of the American school of Philosophy, known as pragmatism. So Charles Peirce, his real name is Peirce, not Pierce, you flip the letters. I imagine many– Did anybody know who Charles Peirce is? That’s okay. Not public education, he was an incredible guy. We don’t make people like this anymore. He did the first randomized control trial. He’s considered the father of semiotics. He is the father of pragmatism and he’s just an incredible person. So here’s the story of Charles Peirce and Hammett was referencing him with the name Charles Pierce, and here’s the story of Charles Peirce because I think it will make you see the connection between insurance and philosophy. I think in a deep way.

So Peirce is a guy who had some issues and he got kicked out of the academy, basically, for reasons that would not have got him kicked out today, philandering and other things. So he’s out of the academy and he’s destitute, William James the American philosopher knows that actually Charles Peirce is the real deal, so he says, “Charles I want you to come back, come to Harvard, give a talk, everyone will understand how brilliant you are and you’ll get back into the academy and everything will be better.” So Charles Peirce says, “Yeah I’m coming.” He comes. He gets special permission to get him back on campus, because he had been kicked out. He shows up and he’s giving a series of lectures and in the first lecture he says, “We are all insurance companies.” And he had written this before. And he says it again and then he goes on to use calculus, to use calculus to get the first order of conditions for pricing insurance policies, basically. People think he’s crazy. William James thinks he’s drunk and in fact the next day throws him under the bus, and writes that Peirce made a complete fool of himself and he was probably drunk. What Charles Peirce was saying is we are all insurance companies. What does that mean? Well, what it means is what’s the fundamental problem of life, randomness everywhere. How do you navigate it? With experience. What’s the essence of pragmatism? It’s the opposite of navel-gazing.

It is experiential learning. How do insurance companies navigate the uncertainty of the world? Experience, that’s the sense in which we are all insurance companies and that’s how he saw pragmatism, the most American school of philosophy there is. So that’s just a way of saying insurance is more interesting than you thought. The rest of the chapter maybe goes through the history of this, why the French Revolution was arguably caused by the mis-pricing of bonds and insurance contracts and how we’ve had these problems for millennia. All right, so let’s give away a book. You can just shout it out, raise your hand, whatever you feel like. So here we go. [mumbled audience dialogue] – There you go. Thank you very much. That was quick on the draw very good, but that’s Jane Austen who is a really incredible novelist from the 19th Century, and you know we can think about risk management in finance by talking about derivatives and doing stochastic calculus or we can talk about it with Jane Austen and Anthony Trollope. So, here’s the underlying idea which is many of Austen’s books and particularly Pride and Prejudice is fundamentally about a risk management problem. So what is that risk management problem? Austen’s pretty clear, if you’re a young man, you get to make mistakes; young women cannot make mistakes. And so a lot of the book is about the risk management problem of young women. So for those of who have read the book. Has anybody read the book? Very good, it’s good. So for those of you who know the book, Lizzy Bennet is of course the heroine and many of these characters have the following problem: suitors come along and each one has a separate kind of problem. Some are rich, but they’re drunks. Some are handsome, but poor. There’s a set of problems with each one and the problem becomes how you think about how you pick the spouse. And in fact if you remember Mr. Collins’ proposal to Lizzy Bennet, it’s like the worst proposal ever. Mr. Collins basically says to Lizzy Bennet– Mr. Collins is not that desirable a guy, that’s all you need to know. He says to her, “You’re not that pretty. You’re not that rich. Here’s an offer on the table. I suggest you take it.” For the young people in the room not a good proposal strategy. She of course says no, but the next day, Charlotte says yes. So he’s of course playing off their risk aversion. He’s playing off her risk aversion. And of course Mrs. Bennet says you better take this thing that’s in front of you. In fact, that risk management problem is even more interesting because these characters actually intuit the logic of modern finance and portfolio theory. So they give voice to options, they give voice to the logic of diversification. So the idea that options and diversification are something that came out of the 1960s and finance theory is ridiculous. d in fact these characters think about this risk management problem with those two instruments; so in Anthony Trollope’s Phineas Finn, this character Violet Effingham, not a very romantic woman; she’s got this problem, the suitors are coming, each one has their own problem, and her friend says at one point, “What are you gonna do? How are you gonna figure this out?” And she says, you know very frustrated, she says, “If only I could marry all 10,” which of course is the logic of diversification. You itemize a choice, you spread it out across multiple sectors and you mitigate your risk in that way. She gives voice to an option strategy. She kind of says she’s gonna line them up, have them ready, and then when she’s ready she’ll strike and hit the bid. That’s just a way of saying these things that you consider new-fangled things are actually things we’ve been doing for millennia.

A first-option contract written by the father of Greek philosophy, you know diversification goes back to ancient shipping, these are not modern things. The second part of the chapter tries to make the case that in fact these ideas like optionality can help you think about the world. So again, a little story about writing the book, when you publish a book, this is my first time, so I listened to what people told me to do. They said you have to write articles and get them published when the book comes out because then people will buy the book. By the way this does not work; if anybody tells you that strategy, it doesn’t work. But I try, I get a couple of things placed, it’s great; people read the articles, it doesn’t change the book sales. But then there’s one article that I cannot get placed and I’m like frustrated, and ready to throw it in, it’s called The Trouble with Optionality. And so the book is about to come out and so I just call up The Crimson, the school newspaper at Harvard, and I say look your commencement issue’s coming out next week, can I give this to you? Are you interested? And of course they’re like, “Yeah, why not, yeah sure.” So they publish it and that becomes the best publicity I’ve ever had for the book. The thing goes viral and eventually ends up catching on in all kinds of ways which is just a way of saying don’t underestimate student newspapers. [laughter] So what do I try to do in that piece and the book, so optionality is this idea of that we have in finance; options are the right to do something. So you have the right to buy something, the right to sell something but you don’t have the obligation to do it. It’s a really fantastic instrument for all kinds of reasons and particularly in insurance. So what I observe in the book and that article is I have young people coming into my office with regularity who say some version of the following: I want more optionality in my life. And people in finance talk like this. They want optionality; so what does optionality mean? I want more choices in the future without being beholden to them. That’s why I go to school, I want more choices, that’s why I go to the prestigious company, because they will give me more choices in the future. That’s why I joined the network; I want more optionality. People in finance think like this and talk like this. In fact more than once I’ve heard the following: marriage is the death of optionality. Stop living in the world of the potential. You live in the real world. So what I observe in that piece is that these people who come into my office and say I want more optionality, the crazy thing is as I see them progress in life, what I notice is they get really good at one thing, which is buying optionality and they spend large chunks of their lives buying optionality, which is a total mis-reading of the function of options. The purpose of buying options is to take on big-inducing product risks. And it turns out buying optionality is addictive. And so they end up spending decades buying safety nets and it’s a complete tragedy because these very, young bright people end up getting addicted buying safety nets and in that sense they over-learned the lesson of optionality. All right, so let’s see if we can give away one more book. So this is harder I think, but maybe you’ll prove me wrong. I’ll give a clue, the Bible.

This is the Parable of the Talents. So I’ll just briefly tell you this Parable of the Talents because it actually corresponds to the finance recipe for value creation in a very interesting way I think. So the Parable of the Talents is this, which the older man with the beard is the master, he’s meant to represent the Lord, and he’s got these three servants. a talent, which you now think of what makes you special was historically money, unit of weight, and it was money. So what’s the parable? So the parable is he’s got these three servants, he’s about to go away and he says to the three servants, “I have something for you.” He goes to the first servant and he says, “Here, I’m giving you five talents. Take care of this, I’ll be back.” He goes to the second servant and he says, “Here are three talents, take care of this, I’ll be back.” So the third servant, “Here’s one talent, take care of this, I’ll be back.” He comes back, he goes away, and he comes back.

The first servant comes to him and says, “Lord I took your five talents and I lent them out, and I made them into ten, here they are.” And the Lord says, “Wonderful, welcome to Kingdom of God.” The second servant says, “I took your three talents I lent them out and I made them into six.” Lord says, “Well done, welcome into the Kingdom of God.” The last servant says, “I only had one talent, and I was worried there was only one talent, and I had to take care of it so I buried it, and it’s safe and here it is back for you.” And Lord says, “Your cast out of heaven and damned forever.”

It’s a pretty weird parable. So what is that about? You know that actually corresponds pretty well to the way we think about value creation in finance, which is saying you are stewards of other people’s capital. They have very high expectations. We call that cost capital. The sine qua non of value creation is beating your cost to capital. The only way to generate capital is go above and beyond what people expect of you of your resources. And in fact, John Wesley, the founder of Methodism, uses this parable to talk about money and how we should think about our lives. The most famous quote I think he’s associated with is: “Giveth to us many as you can for as long as you can and in as many ways that you can”. That is the logic of this parable and it also according to John Wesley at least, but it also the logic of the value creation recipe in finance. Beat your cost capital, beat if for as long as you can and hold on to as much capital as you can at that rate of return. That’s what we teach as the source of all value. This chapter also has a way to think about the capital asset pricing model, I won’t go into any detail but the idea of betas for those who might be familiar with that, turns out to be a wonderful way to think about… the relationships in your life, in a kind of interesting way. All right, so let’s give away another book. This one I think is a little bit in-between. So let’s see.- It’s a movie. Yes! Well done. – [Audience Member] It’s a Hirschfield drawing. – It is a Hirschfield drawing. You get bonus points. You get two books. It’s an Al Hirschfeld drawing that’s exactly right and that’s Gene Wilder and Zero Mostel from The Producers in 1968, Mel Brooks, incredible movie. So corporate governance is I think is the most important problem in modern capitalism. It’s the principle agent problem. It is the problem that I own a share of Apple, and yet Tim Cook doesn’t always take my calls. Which is a way of saying I’m his principal, he’s my agent. I have trouble monitoring him, he’s supposed to be acting in my interests, but I don’t know if he is. That is the principal-agent problem. You can talk about that in many ways, or you can use The Producers, the plotline is basically is this. These two guys get this idea, they’re gonna put on a Broadway musical, they’re gonna raise way more money than they need, like 2500% of what they need.

Then they will make the worst musical ever, and it will close right away, and then the investors will never know that they funded 2500% of what the show costs ’cause they’ll know it’s a failure and they’ll never ask for their money back and these two guys will go to Rio. It’s a great plan; they put on the worst musical ever. It’s called “Springtime for Hitler,” totally tasteless, worst acting, worst directing, worst everything, and it’s like a fantastic success and they go to jail. Great story, I suggest you rent the movie tonight. The reason that’s important is that is the problem of modern capitalism which is we give our money and our capital to other people to manage and to govern, and the miracle of modern capitalism is that process works at all. A hundred and 50 years ago, this was not really a problem in the following sense: most of us had the privilege of working for ourselves. Ownership and control was together. Now, what is the story? Tim Cook, think about Apple for a second, Apple has a huge shareholder revolt four or five years ago, and what happens, David Einhorn, Joe Hedge Fund guy, gets angry and he says to Tim Cook, give me my cash, you’re sitting on all my cash, give me my cash. What’s Einhorn saying?

Einhorn’s saying, “I’m your principal, I’m your owner, what are you doing, start giving me the cash.” And Tim Cook ultimately relents and says, “Yes, I’ll give you the cash.” But the problem is more complex, because David Einhorn, Joe Hedge Fund guy, who is the principal of Tim Cook, is himself the agent of some Canadian pension plan, who’s allocated assets to him. And in fact by the way that money manager at the Canadian pension plan, she herself, in addition being the principal of David Einhorn, who was in turn the principal of Tim Cook, she herself is the agent of the Canadian pensioners that she represents. In that sense modern capitalism is one big daisy chain of principal-agent problems and that’s partly what makes it so amazing. This way of thinking about the world principal agents I try to argue in the book is really a powerful lens on everything. And we were talking earlier today, this is like the weirdest chapter by far, I don’t know if it succeeds, I think for some people it succeeds, because I try to use the principal agent problem to think about all kinds of things in life. So, I’ll give you a couple examples of that. You know obviously in any work setting the principal agent setting is there all the time. I delegate a task, I try to help that person succeed, I have to get the resources, I can’t monitor that person all the time, you know think about you get a contractor to do some repairs on your house, did they use the right kind of concrete? Your doctor tells you have to get an MRI. Does she own the MRI clinic? These are principal agent problems, they’re everywhere. It turns out I think a powerful way to think about your life, I’ll give you an example from my life, which is several years ago after my father passed away, my mother was living by herself. And my sister and I lived very, very close to each other and we were worried about my mom, because of the solitude we thought could reach depression, we were worried about a lot of different things.

And so we’re talking to each other what are we gonna do, and so then we hit on it, and it’s just like one of the ideas that comes to you and you’re like, “Why didn’t we think about this.” And the idea is this, we’ll move my mom close to us in the same building, she’ll be close to us, there won’t be any solitude, she’ll be close to her grandkids, this will be fantastic. I go talk to my mom, I said mom, “I gotta great idea, blah, blah, blah, blah, we’re gonna move you. It’s going to be fantastic, blah, blah, blah, blah.” And she says, “No.” And I say, “Mom, let me try it again. I don’t think you understand,” And I go, “Blah, blah, blah.” And she just says, “No,” and at that moment I kind of realized that I thought I was serving her. I was an agent, she was supposed to be my principal, maybe my father was a hidden principal somewhere who I was trying to serve. In reality I had made her my agent. My sister and I wanted her close by. We wanted her close to our kids. We didn’t wanna schlep and go see her. And in the name of serving as her agent we were actually making her into ours. And that confusion between principals and agents, I think, is everywhere.

The story, the chapter ends, the chapter has Mel Brooks sprinkled throughout. It ends with the story of Mel Brooks and Ann Bancroft. His wife, Ann Bancroft is like this incredible actress. Mel Brooks is a producer and a writer. So the story is the following: Ann Bancroft comes home one day and says, she been acting all day, she says, “I hated it, the script was terrible, the director was terrible,” blah, blah, blah. She’s complaining, complaining. So Mel Brooks finally stands up and he says, “You think acting is hard,” and he holds up a blank piece of paper, and he says, “This is hard.” Which is a way of saying being an agent is hard thing but the really hard thing in life is trying out how to become principal, and we often find ourselves reading other people’s scripts as opposed to writing our own. All right, I think this is a really hard one. I’ll do this chapter pretty quickly. Yes, it’s the Arnolfini portrait. Fantastic, thank you very much. So this is a portrait by von Eyck and it’s part of the mergers chapter. So mergers are when two firms combine. This is the cheekiest chapter and it’s about how the worlds of love and money have been intertwined forever. The title of the chapter is No Romance without Finance, which is just a way of saying first, these worlds have been intertwined forever. The reason I chose this picture is there’s controversy over what it represents, as you may know. Some people think it’s a wedding. Many people think it’s actually the payment of a dowry. The reason that’s interesting is, and this gives you a sense about how these worlds have been linked forever, it just told the story of the dowry fund. So the dowry fund is the primary way Renaissance Florence gets financed. So what is the dowry fund? There are three problems in Renaissance Florence: first, dowry prices are going through the roof. Sorry, dowries are payments by fathers of daughters to grooms. Not an idea that we have to discuss, but that’s what the practice was. Dowry prices are going through the roof because young men are in short supply, because of the bubonic plague. So fathers are having a real problem with dowry price inflation. Second problem, is the fathers are stiffing the grooms. The grooms get married to the women and then the fathers don’t pay. And then the final problem is Renaissance Florence needs a lot of money to fight Genoa and Luca. The dowry fund is born.

What is the dowry fund? Fathers of daughters– I have three– give money to the state at age five. When they mature, at age 15, you get a nice rate of interest on that loan that you made to the state. Protects you from dowry price inflation, and we pay directly to the groom, we don’t give it back to the father. This is like the dominant way Renaissance Florence gets financed. It’s kind of a cheeky way of saying these world of finance and romance have been linked forever. The big part of the chapter is on mergers. It turns out we know a lot about when companies merge, how, and why they work, and when and how it fails. It turns out the failure rate for mergers is really high, like 50%, you know mergers are Microsoft buys LinkedIn, whatever recent merger was announced. CVS buys Aetna all kinds of crazy things can happen. Questions, when and how do mergers succeed? I’m trying to make the case in the chapter that actually the lessons that we know about mergers actually end up looking like some of the folklore around what makes for good marriages and that parallel is kinda remarkably robust. All right so let me see if this next picture, I think this would be easiest one but I could be wrong. I thought this was the hardest one and you got it, so. The building in the back might help. The Merchant of Venice, thank you very much. That’s the Merchant of Venice. This is of course is a play about debt. There’s a loan from Shylock, who’s the guy on the right, this is a pound of flesh pay, who makes a loan to Antonio, who then has to make a loan to Portia and so on and so forth. The whole play is about debt and there’s all this wordplay about bond, my bond, and my body and all this stuff. So they people who study the play make it clear this is not a play about debt, this is a play about love and commitment. And in fact in no Shakespeare play is love used more often than in the Merchant of Venice. And what’s the idea underneath all this, and what’s the idea in finance about debt? People in finance love leverage. They love talking about leverage. And the underlying idea is this, which is I make a very, very strong commitment to my lender. Sorry, to the person who’s gonna lend me money. I sign over a lot of rights, they get a lot of rights over me when I fail to actually pay them back. And because I make that very strong commitment, what happens: I get to do things I have no right to do. So what does that mean, why is leverage so fantastic? You get to buy a house you have no right to buy. You get to buy an education you have no right to buy. You get to control assets you have no right to control. That is the magic of leverage. And in some sense it is the same story about commitments, which is commitments in life allow you to do far more than you can imagine doing by yourself. I tell this by virtue of two artists who I think are both, one is low-leverage, on is high-leverage.

So the low-leverage guy is George Orwell. So George Orwell is a guy, post-World War II. He’s gotten sucked dry by commitments. He’s a journalist, he can’t write the novel he wants to write, so he goes to the Scottish Islands, locks himself up for three years and writes 1984. That’s a low-leverage guy, just shorn his life of commitments and he creates a masterpiece. So who’s a high-leverage guy? So Jeff Koons is modern American artist who makes massive sculptures, that take up a quarter of this little space right here. And how does he do it? Well, he employs about 150 people in his factory. He doesn’t actually know how to work with the material that his sculptures are composed of. He’s gone bankrupt three times. He bankrupts dealers with regularity. He sells work before it’s produced. That is leverage and as a consequence he gets to create things that he would never have been able to create without all those commitments. So that’s just a way of trying together the idea of commitment, which is implicit in leverage, with commitment in life. The chapter ends in a quote by Jefferson, and I should just say that the cover illustration is Archimedes which has that quote: “Give me a place to stand, and a lever, and I can move the world.” That’s the Archimedes quote, which is of course is what people in finance love leverage for, as well. You get to do things you get no right to do, that’s why lever is an amazing thing. So Jefferson says, “I’ve always thought it the best to do the right thing,” because if you do the right thing the world provides you with a great reputation and like Archimedes’ lever, with a reputation and a place to stand you can do anything. Which is a way of saying what is reputation? You commit yourself to behavior and the world lets you do things you have no right to do. That’s what the power of reputation is.

All right so maybe we can finish with this one and I went a little longer than I thought I would go. So does anyone know who Robert Morris is? So here’s the quick story about Robert Morris and then I’ll stop. So Robert Morris is the richest man in the colonies. He is the financier of the Revolution. His script finances The Battle of Yorktown. He wrote his name on a piece of paper and that allowed Washington to fight the battle of Yorktown. He in fact, is the first Superintendent of the Bank of the United States during The Articles of Confederation. George Washington asks him to be the first Secretary of the Treasury before he asks Hamilton. And in fact Morris suggests Hamilton. And you don’t know who Robert Morris is and Alexander Hamilton has his own musical on Broadway. So what happened, and the answer is, after he turns down Washington for the Treasury job, he says I wanna recoup my wealth. So I was such a wealthy person I have lost some wealth. He goes on to recoup his wealth. He becomes wildly rich again, he owns 40% of the District of Columbia, as it’s being made into the Capitol. He owns by some measures a third of New York State. Wealth beyond imagination. And then he goes bankrupt because of the excessive use of leverage. And so what happens? Well what do we do to people who go bankrupt? We throw them in jail. And he ends up in the 30th Street jail in Philadelphia. And he spends almost seven years there and then right before he dies he’s released. It’s a shame. Washington sees this, and other founding fathers see this, and that is the genesis of how we started to change our way of thinking about bankruptcy. That gives rise to the 1800 Bankruptcy Act, where we take the change from thinking about bankruptcy as being about death, and we make it about rebirth.

So how does finance think about bankruptcy? Financing thinks about bankruptcy, now today, the modern notion of bankruptcy, is we protect the person who fails. That’s what we do, we protect somebody who fails. We actually make sure they get the resources they need. We let them restructure claims. We provide them with advice. We do all kinds of things to protect them ’cause they’re actually the ones who need protection, not the ones who lost the money. It’s an interesting way to think about failure. It’s a very forgiving attitude towards failure. And I think it’s an attitude towards failure that is useful more generally. The chapter goes on to suggest that it’s just a little bit more complicated than that, failure is more complicated than that, and bankruptcy’s more complicated than that, and that’s because we can have strategic bankruptcies. People who use bankruptcies to get out of their obligations. If you strain your mind, you may be able to think of one or two or three. And that makes a bankruptcy a much more morally complex thing. So the last chapter is about, Why Everyone Hates Finance. I can talk about that if you like. I apologize I’ve already run way over. But I think this pretty clear what this is about and what I think the book tries to do and what I think we should all be trying to do more and something that you have already figured out, which is these two worlds should be drawn together and they should be drawn together because first the humanities can de-mystify finance, and hopefully the humanities can help rehabilitate finance. We need humanization of finance really badly for reasons that are pretty evident and our best chance of that is to anchor people back in the ideas and ideals of finance, so they stop with the spreadsheets and the screens, but the think about the moral complexity of what they do and the best way to think about moral complexity is the humanities and so that combination has the promise of hopefully improving the actual promise of finance. [crowd applauds]

Search University Place Episodes

Related Stories from PBS Wisconsin's Blog

Donate to sign up. Activate and sign in to Passport. It's that easy to help PBS Wisconsin serve your community through media that educates, inspires, and entertains.

Make your membership gift today

Only for new users: Activate Passport using your code or email address

Already a member?

Look up my account

Need some help? Go to FAQ or visit PBS Passport Help

Need help accessing PBS Wisconsin anywhere?

Online Access | Platform & Device Access | Cable or Satellite Access | Over-The-Air Access

Visit Access Guide

Need help accessing PBS Wisconsin anywhere?

Visit Our

Live TV Access Guide

Online AccessPlatform & Device Access

Cable or Satellite Access

Over-The-Air Access

Visit Access Guide

Passport

Passport

Follow Us