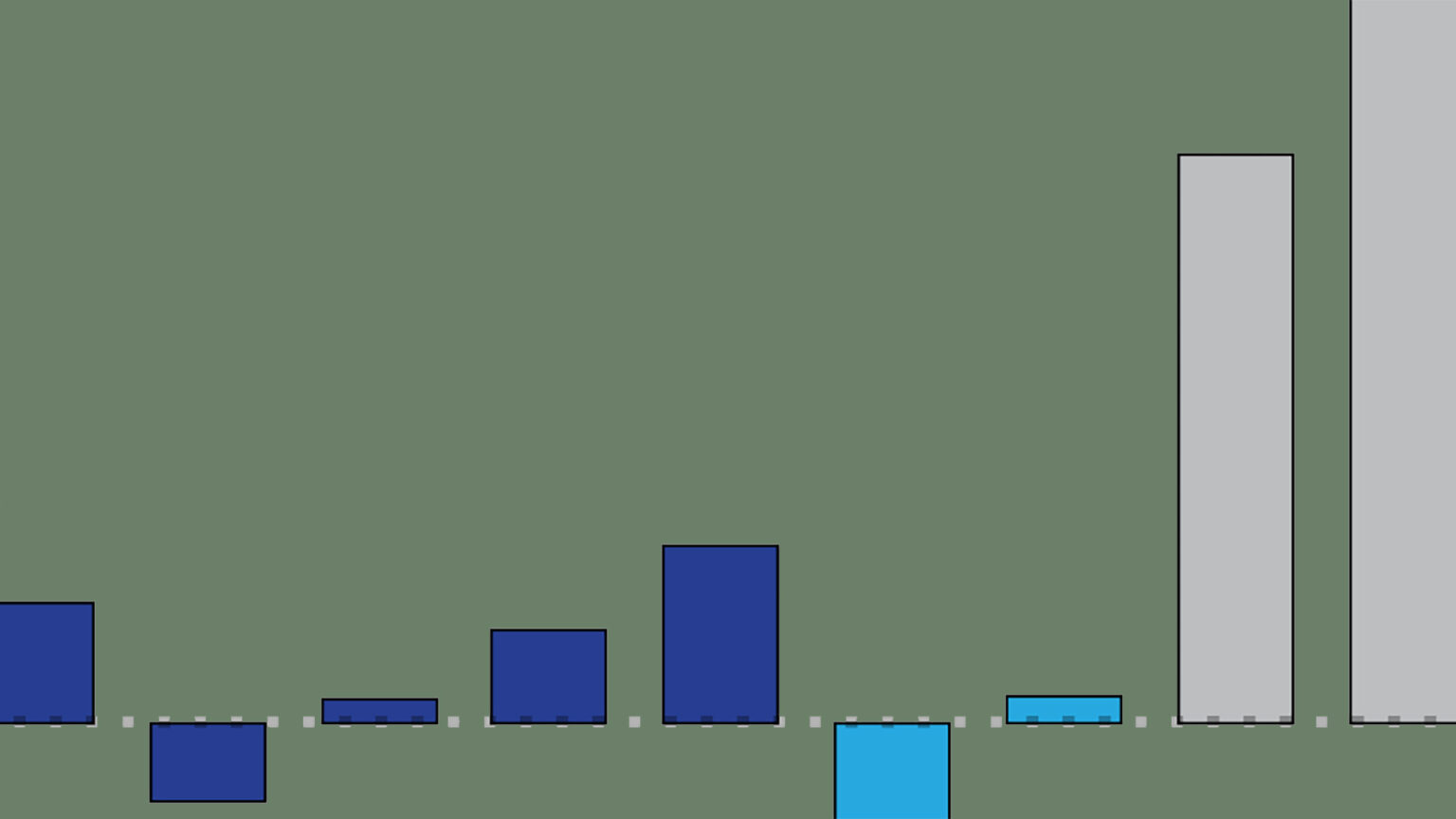

Wisconsin's burgeoning surplus sets up a wealth of 2023 budget options

A report released by the Wisconsin Policy Forum details how the state government's tax collection revenues have increased so far in the 2020s and what that growth means for the politics of budget making.

December 6, 2022

(Credit: Adapted from Wisconsin Policy Forum)

The Wisconsin state government’s financial future has never looked so bright.

Revenue estimates released by the Wisconsin Department of Administration on Nov. 21 even went so far as to say “the fiscal condition of the State of Wisconsin is in its strongest position in state history.”

That optimism stems from projections the state will end the 2022-23 fiscal year with a budget surplus of more than $6.5 billion. In turn, that’s led to political positioning and speculation about how to spend this money as the governor and legislative leaders head into the biennial budget-writing season.

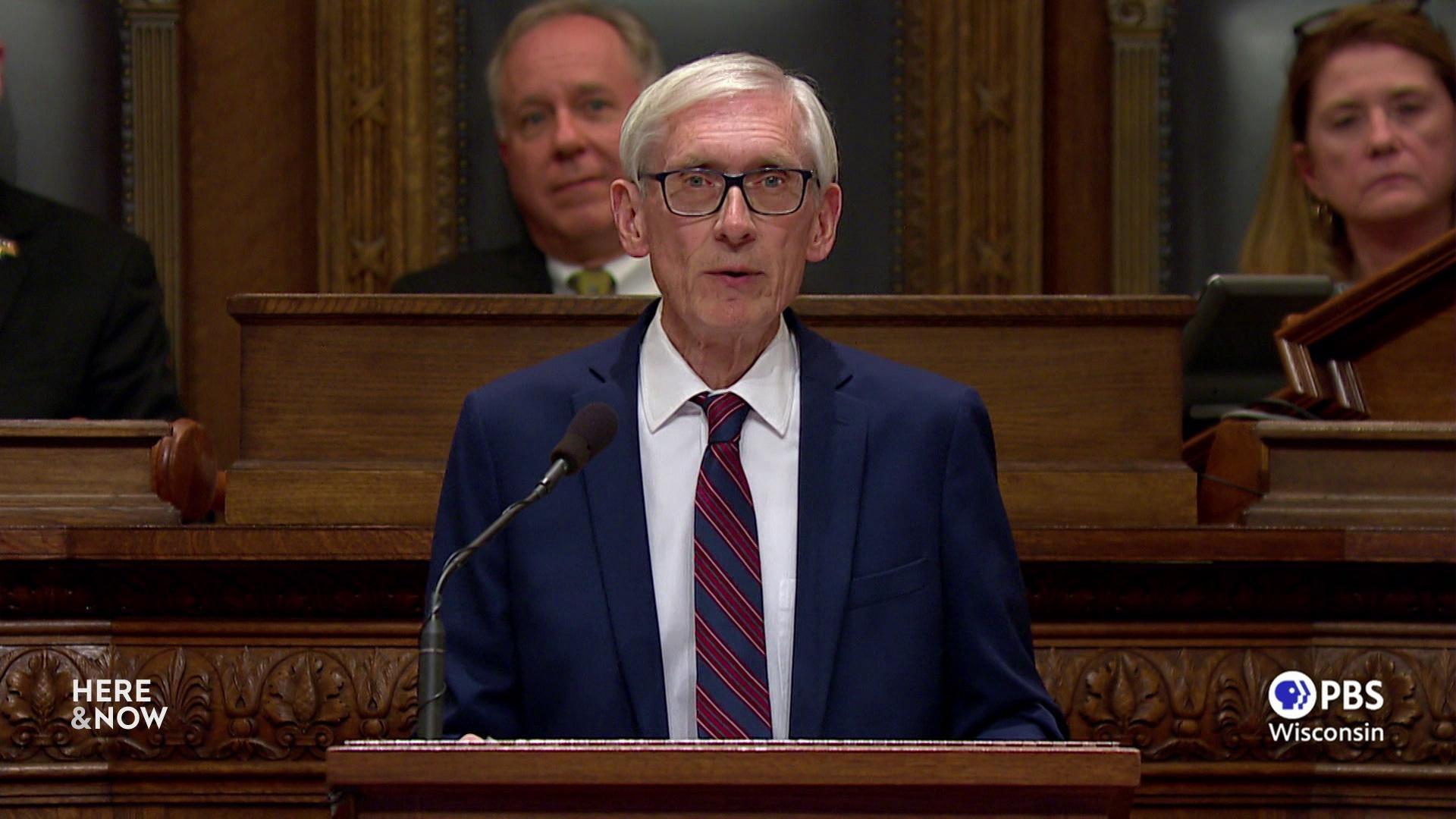

Democratic Gov. Tony Evers has proposed using the money to increase education funding and carve out a middle class tax cut. Alternately, Republican leaders have floated ideas like large-scale tax system changes as well as using the surplus to grow the state’s so-called rainy day fund balance.

A Wisconsin Policy Forum analysis of the state budget surplus, its sources and possible financial opportunities shows that with a stockpile of several billions of dollars, there’s room for a number of funding decisions to be made.

This report, released in December 2022, also notes that it may be best to proceed carefully in the face of a potential recession in 2023 as well as other economic uncertainties.

In addition to the extra $6.5 billion the state is projected to have on hand by the end of June, the analysis shows an even larger surplus may be coming over the two-year budget cycle.

“We find general fund revenues are currently projected to exceed budgeted spending by a staggering $6.8 billion over the two-year cycle running from July 2023 to June 2025,” stated the analysis. “The excess revenues amount to just under $3 billion, or 15.3% of spending, in year one of the budget and more than $3.8 billion, or 19.6% of spending, in year two.”

While that projection doesn’t include rising costs, such as service increases at state agencies that could cause the total to be lower, “the state is in a much better position this year to shoulder the increasing costs of ongoing state and local services and make new commitments.”

The source of these surpluses is due to a combination of a few revenue changes – and of course, the impacts of inflation.

“The growth in tax collections is due to factors that include federal pandemic relief, previously low interest rates and the rise in consumer prices, which boosts sales tax revenues in particular,” the report explained. “The lower spending is due in part to the federal government shouldering a larger share of Medicaid costs during the pandemic (that assistance is expected to end next year) and lawmakers opting to limit overall state and local funding for schools and local governments while they have been receiving one-time federal COVID-19 aid.”

The Wisconsin Policy Forum analysis lays out a number of options new commitments the state could enter into, including increasing shared revenue payments to local governments, additional funding requests from UW System universities and the technical college system, repealing the personal property tax, reducing state income tax levels, increasing general school aid and funding Medicaid services.

While some financial fluctuation is certain due to possible recession, economic disruptions related to the ongoing war in Ukraine, and general volatility of businesses and the stock market, “for now, state officials can expect a strong budget and an opportunity to increase state spending, cut taxes or both,” concluded the report. “When writing budgets, lawmakers typically face agonizing choices between meeting the needs of the present and preparing for future challenges that are hard to predict, like a potential recession. This time, state officials may have the financial wherewithal to accomplish both.”

Passport

Passport

Follow Us