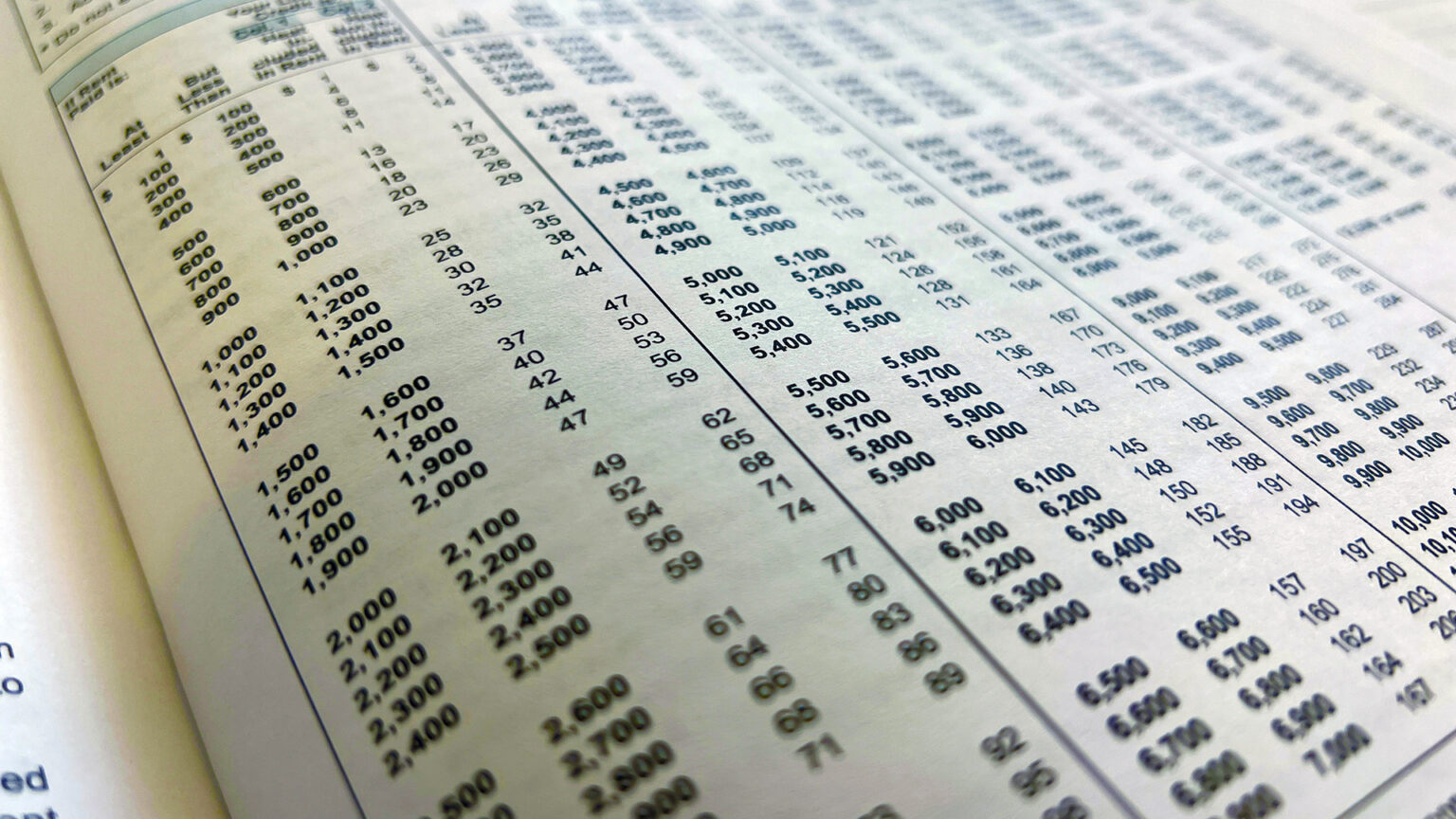

Making sense of what a state flat tax on income means for Wisconsinites

The Republican majority in the Wisconsin Legislature is calling for a flat tax in response to an historic state budget surplus — a public affairs professor at UW-Madison explains how this approach to taxing income is implemented as policy and has worked in practice.

January 19, 2023

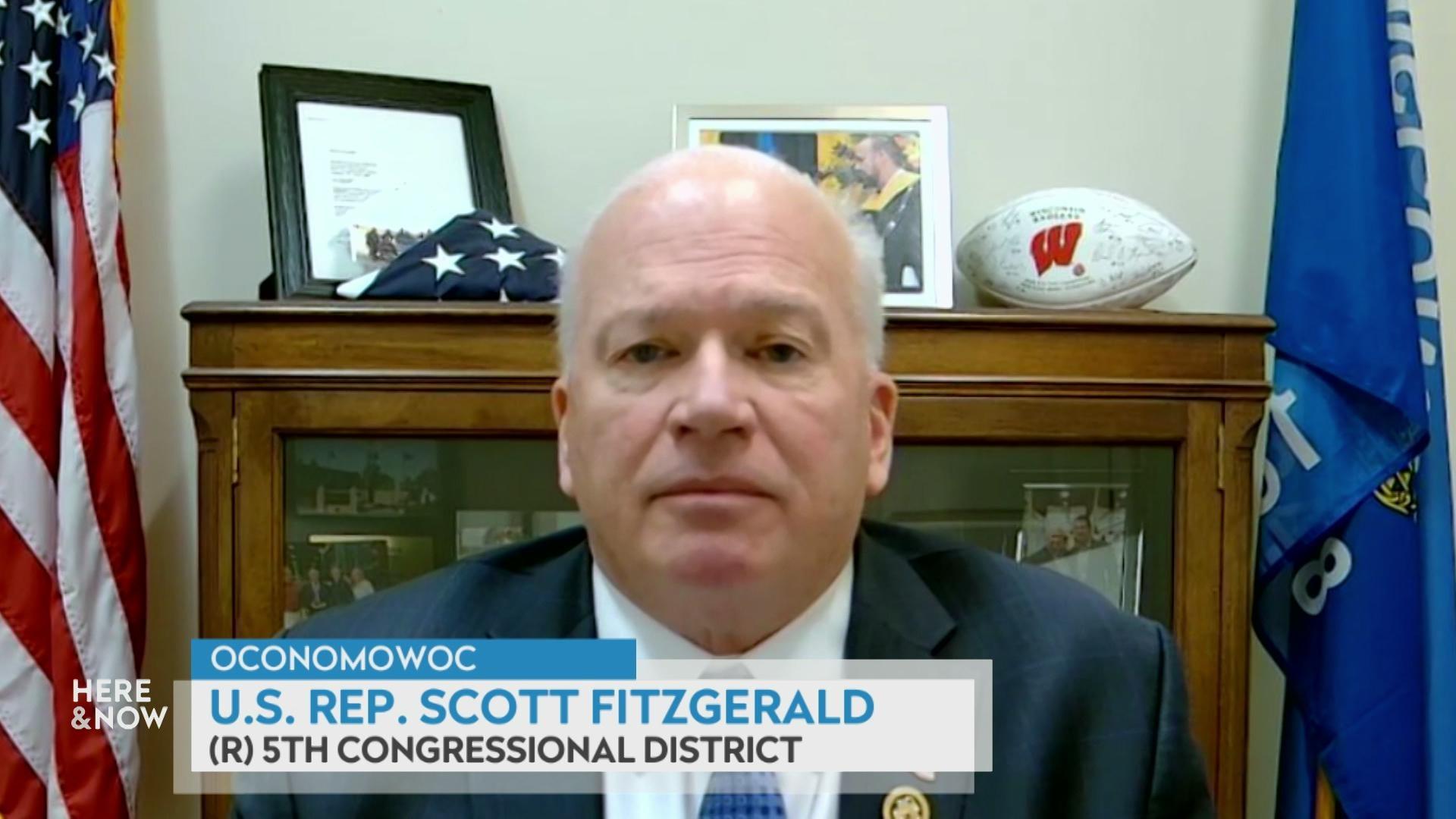

(Credit: Steven Potter / PBS Wisconsin)

There’s been a lot of political chatter about Wisconsin becoming what’s called a “flat tax” state.

Republican proponents of the idea – which would establish a uniform state income tax rate – have begun laying the groundwork to make their proposal a reality.

On Jan. 13, state Senate Majority Leader Devin LeMahieu, a Republican representing a district that encompasses Manitowoc, Sheboygan and the surrounding area, introduced legislation to make the tax change. He said the move would be “a tax cut for ALL Wisconsinites” and promised that it will provide “much-needed tax relief for middle class Wisconsinites and main street businesses.”

LeMahieu’s plan calls for transforming Wisconsin’s current four-tier state income tax rate system, which ranges between marginal tax rates of 3.54% to 7.65% depending on income, to a one-size-fits-all — hence “flat” — tax rate of 3.25%.

During his address opening the 2023 legislative session, Assembly Speaker Robin Vos voiced his support for the change, noting that a flat tax rate would make Wisconsin more like its neighbors.

“When I look at our tax climate, I see that all around us are flat taxes in Iowa, Michigan, Illinois,” said the Republican representing a district west of Racine.

Democratic Gov. Tony Evers, however, has signaled that he’s flatly against a flat tax rate because it would disproportionately benefit the wealthy. Instead, he’s said he favors another type of tax cut for Wisconsin residents.

Much of the conversation about taxes, tax rates and tax cuts has been prompted by the unprecedented state budget surplus of more than $6 billion, which is money collected largely from income, corporate and investment taxes.

Aside from partisan debate over a possible shift to a flat income tax, achieving such a monumental change to an inherently complicated state taxation system is a much bigger deal than the simply-named “flat-tax rate” implies.

Here & Now spoke with Ross Milton, an assistant professor at the La Follette School of Public Affairs in the University of Wisconsin-Madison who studies the impact and effects of different tax policies, to break down this issue into dollars and sense.

What’s the difference between Wisconsin’s current tax system and a flat-tax rate system?

Milton: We have a graduated tax system where there are different income tax rates depending on your income level – that’s known as having progressive tax rates. A flat tax means that rather than having a graduated set of tax rates where there are multiple tax rates for different income levels, there’s only one tax rate that everybody pays.

There’s been a lot of discussion about flat tax systems — nationally, are more states shifting to a flat tax system?

Milton: Yes and no. I would say that state tax systems are moving in both directions. Some states have been moving to adopt flat taxes to move away from graduated tax systems. And at the same time, some states are implementing new, higher, sometimes called “millionaire taxes” on very high-income taxpayers. For instance, Massachusetts used to have a flat tax and now it will have that for everybody except for this new so-called millionaire tax. We’re seeing the adoption of millionaire taxes in other places like California and New York as well. So what’s happening is more like a bifurcation of tax systems than anything else.

The name “flat tax system” seems simple. But it’s taxes, so it’s bound to be complicated. What are some of the finer details to consider in this discussion?

Milton: There’s a lot of variation in flat tax systems and how they actually affect taxpayers. The simplest thing to think about is that they differ quite a lot in how big their standard deduction is for their exemptions. So the question is when do you start paying this flat tax rate? Is it at $5,000 in income or is it at $20,000 in income? And for low-income taxpayers, that makes a big difference. We need to consider, if it’s a flat tax rate, then what is that tax rate and then how are they changing the standard deduction rate? In order to make a flat tax system not dramatically increase taxes on low income households, it would have to be accompanied by a potentially substantial increase in the size of the standard deduction.

There are people and politicians on both sides of this issue. What are some of the pros and benefits of switching to a flat tax system?

Milton: Some people argue that it would increase the competitiveness of Wisconsin. If you imagine a high-income person who’s deciding where to live, one of the factors could be how much taxes they would pay in each state. The big question is how often do people actually face that scenario and how sensitive are they to the tax rate? The best evidence we have is that millionaires actually move less than less rich people. But when they do move, they’re more likely to move to a lower tax place. Also, some people make a fairness argument where they just think that high income residents are paying too much and we should not make them pay that much.

Is one of the benefits of the flat tax system also simplicity?

Milton: Certainly. I’ve heard people say that there is a simplicity argument and on some level there is when four numbers are reduced to one number. But if you think about all of the complexities of even just a state income tax system, much less the combined state-federal income tax system, such as, you’ve got all of these tax credits that most people don’t understand. And if the real goal is tax simplicity, I think that a broader examination of the tax system would really be in order, not just thinking about turning four numbers into one.

What are the cons and possible disadvantages of a flat tax system?

Milton: The cons depend a lot on how the flat tax proposal is structured. It will always be the case that it primarily benefits high-income households, but it could be a tax cut for everybody if there is a big enough increase in the standard deduction.

We’re thinking about a flat tax right now because we have these huge budget surpluses. I think that the concern that many people have about big tax cuts now is that we need to have sustainable tax policy that sets our state on a good trajectory that we will be able to maintain, not one where we’re going to have wildly oscillating tax policy every few years when we realize that we cut taxes too much and our state’s going bankrupt.

The other big thing is what is a flat tax system going to look like for low-income residents? Will it mean that they’re paying more taxes than they did before, particularly if part of it is going to be an increase in state sales taxes? Sales taxes hit low-income residents harder, so if a sales tax increase were somehow combined with cuts to income taxes, many people would be opposed to that because of its effect on low-income residents.

Passport

Passport

Follow Us