LeMahieu proposes flat income tax rate for Wisconsin by 2026

Republican Senate Majority Leader Devin LeMahieu plans to propose moving Wisconsin to a flat income tax rate of 3.25%, with Democratic Gov. Tony Evers vowing to block the proposal.

Associated Press

January 13, 2023

State Senate Majority Leader Devin LeMahieu, R-Oostburg, speaks to another senator on the dais in Senate Chambers at the Wisconsin State Capitol in Madison on March 8, 2022. The Republican leader of the Wisconsin state Senate is proposing on Jan. 13, 2023 for the state to move to a 3.25% flat income tax rate by 2026. (Credit: PBS Wisconsin)

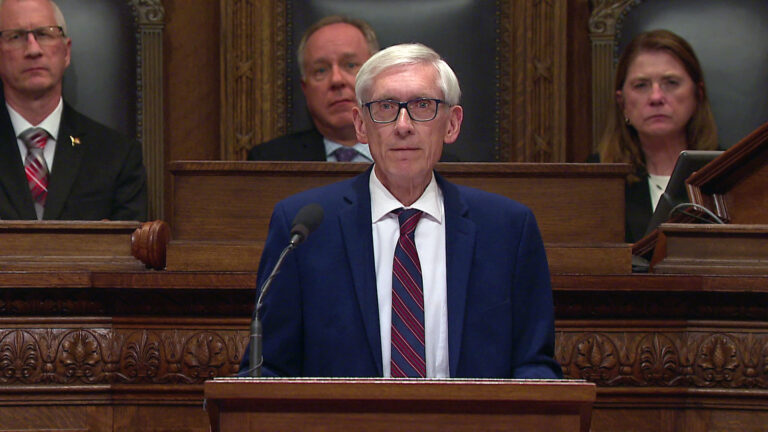

MADISON, Wis. (AP) — The Republican leader of the Wisconsin Senate proposed implementing a flat 3.25% income tax rate, a plan that Democratic Gov. Tony Evers has vowed to block saying it benefits the wealthy over the middle class.

The conflict comes as both sides say they want to tap a nearly $7 billion state budget surplus to lower taxes. Evers has also listed other costly priorities that will compete with cutting taxes, including increasing funding for K-12 public schools and giving local governments more money.

Republican Senate Majority Leader Devin LeMahieu’s proposal, which he circulated for co-sponsors on Jan. 13, would phase in a flat income tax rate of 3.25% by 2026. Each of the brackets would gradually decrease over that time before becoming one. Income tax rates are currently split into four brackets, ranging from 3.54% for those earning up to $12,760 to 7.65% for those earning more than $280,950.

Over the first two years, the state would collect $4.9 billion less tax revenue, according to the nonpartisan Legislative Fiscal Bureau. The state would take in $4.3 billion less in the third year and about $5 billion less in the fourth year.

Last fiscal year, the state collected about $9.2 billion in income taxes. Under the plan by 2026, the state would collect roughly half as much, depending on inflation, economic growth and other factors.

For taxpayers, the average tax decrease would be $4,415 over the four-year phase in period and about $1,800 a year after that, according to the fiscal bureau.

LeMahieu argues the move will make Wisconsin more competitive. He contends in the memo sent to lawmakers Jan. 13 that a flat tax will help Wisconsin businesses that are structured in such a way that they pay personal income taxes.

LeMahieu also argues that Wisconsin’s top rate is out of whack nationally, with 31 states having a top rate that is lower than Wisconsin’s third tier rate of 5.3%. By moving to a flat 3.25% rate, only 11 states will have a lower top individual rate, LeMahieu said.

Other Republicans, in arguing for the move, have also pointed to neighboring Illinois, a state run by Democrats, which has a flat personal income tax rate. Illinois voters in 2020 also rejected a constitutional amendment that would have allowed for lawmakers to change that and institute a progressive income tax system like Wisconsin’s.

Evers and Democrats in the Legislature are against the flat tax, saying it will primarily benefit wealthy people.

“When we deliver tax relief, it should be targeted to the middle class to give working families a little breathing room — not to give big breaks to millionaires and billionaires who don’t need the extra help to afford rising costs,” Evers tweeted Jan. 13. “That’s just common sense.”

Under LeMahieu’s plan, for example, those already in the lowest tax bracket would see only about a quarter percentage point tax cut, while the wealthiest would have their tax rate cut in half.

Democrats don’t have the votes to stop the measure from passing, but Evers can block it with his veto.

“I don’t see that as something that I could support,” Evers said of the flat tax in December 2022. “I believe that targeting the middle class is where we should be. We should continue to have a progressive tax system.”

Evers is pushing a plan that would cut income taxes 10% for individuals earning less than $100,000 and families earning less than $150,000.

Evers’ $600 million proposal would also cap copays for insulin at $35, repeal the state’s minimum markup law in an attempt to lower gas prices, cut taxes for seniors on fixed incomes, expand property tax relief for veterans with disabilities, and attempt to lower the cost of caregiving and child care.

The debate over what taxes to cut and by how much will be a large focus of the Legislature’s work in 2023. Wisconsin’s budget is projected to have a nearly $7 billion surplus, fueling support from both Republicans and Democrats to cut taxes. The last state budget, passed by the Republican Legislature and signed by Evers, cut income taxes by more than $1 billion.

Wisconsin’s total tax burden, which is total taxes measured as a share of personal income, fell to its lowest point in more than 50 years in 2022, according to the Wisconsin Policy Forum. However, the state’s average income tax rates are more favorable to high- and middle-income residents and worse for those with lower income, the Wisconsin Policy Forum reported in 2022.

Editor’s note: This story is corrected to show the cost of the flat tax proposal is $4.9 billion over the first two years, $4.3 billion in the third year and $5 billion in the fourth year.

Passport

Passport

Follow Us