Wisconsin Supreme Court rules Delavan properly excluded dark store tax comparison

A unanimous state Supreme Court decision found a state manual recommends property assessors shouldn't use dark stores as comparable valuations in a case involving the city of Delavan and a Lowe's Home Center.

Associated Press

February 16, 2023

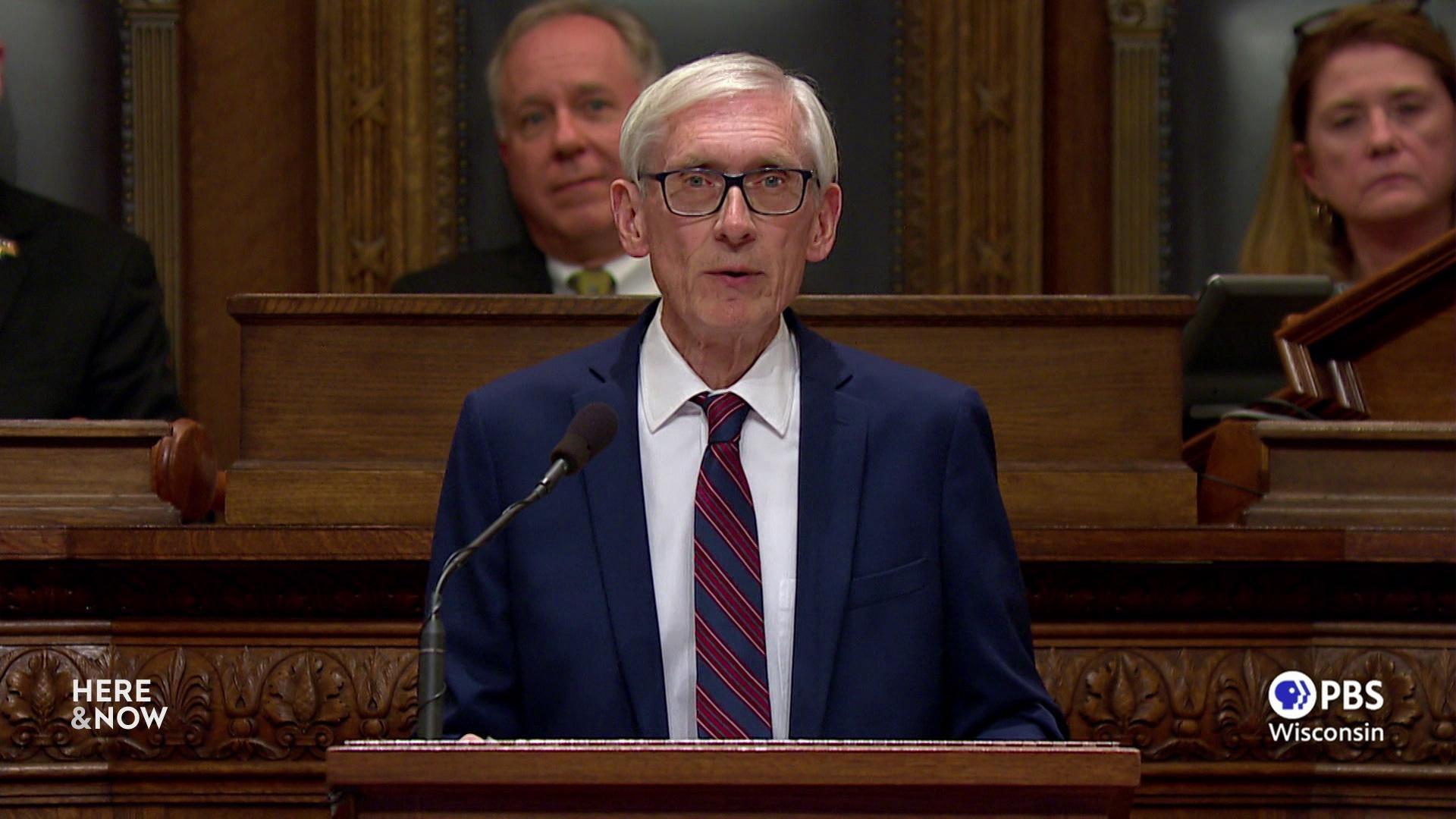

At attorney speaks to Wisconsin Supreme Court justices during oral arguments on Sept. 28, 2022, for a case involving long-vacant commercial properties called "dark stores" and how they affect property tax assessments by municipalities. (Credit: PBS Wisconsin)

MADISON, Wis. (AP) — Tax assessors for the city of Delavan properly excluded comparable dark-store valuations when setting a new property tax rate for a Lowe’s Home Center in 2013, the Wisconsin Supreme Court ruled Feb. 16.

Attorneys for Lowe’s had argued that assessors should have considered what six comparable vacant stores were worth when they revalued the home center at $8.9 million. They argued that had the assessors factored in the vacant stores’ valuation the home center would be worth about $4.6 million.

A state appeals court ruled in 2021 that the assessors’ valuation enjoys a presumption of correctness. The state Supreme Court upheld that decision, ruling unanimously that the Wisconsin Property Assessment Manual recommends that assessors shouldn’t use dark stores as comparable valuations and Lowe’s failed to prove the city’s assessments were excessive.

The court noted, however, that the ruling applies only in the Delavan case and the manual doesn’t strictly prohibit using dark stores as comparable properties or offer any guidance on when a dark store can be compared to an occupied property.

Lowe’s attorney Dan Devany didn’t immediately return an email seeking comment on the ruling.

Passport

Passport

Follow Us