Foxconn Plans to Make 'Digital Infrastructure Hardware' in Wisconsin — What's That?

Here & Now Extra: Under its revised tax incentives contract with the state, the global electronics giant proposes to manufacture products essential to conducting business and living life in "the cloud."

By Will Cushman | Here & Now

May 10, 2021 • Southeast Region

Foxconn struck a new economic development deal with Wisconsin, but what exactly the Taiwan-based manufacturer plans to produce in the state remains a mystery.

In April, the Wisconsin Economic Development Corporation signed off on a majorly scaled-down tax incentive package for Foxconn. The amended contract comes less than three years after the company broke ground on a much-hyped campus in Racine County where it originally promised to build large LCD screens.

Those plans did not come to fruition. At the same time, Foxconn officials have become more circumspect about their plans for Wisconsin. In a statement lauding its revised contract with the state, the company stated the terms were “based on Foxconn’s current projections for digital infrastructure hardware products through 2025.” It didn’t elaborate on what exactly those products might be.

What are “digital infrastructure hardware products,” and how could they fit into the global electronics manufacturer’s Wisconsin operations?

The latter question remains unanswered for the time being. Foxconn officials did not respond to multiple queries about its intentions, and a spokesperson for the Wisconsin Economic Development Corporation referred questions about any plans to the company.

However, on a broad basis, the term digital infrastructure hardware is used in specific ways in engineering and economic development realms.

Parmesh Ramanathan is a professor of electrical and computer engineering at the University of Wisconsin-Madison whose research centers on improving wireless networks and electric grids through new technologies. He said digital infrastructure hardware can include any number of products that support contemporary digital needs, which increasingly depend on internet-connected devices relaying information back and forth via vast off-site collections of servers called data centers.

Data centers form the backbone of what is commonly known as “the cloud.” Cloud computing is a major component of 21st century digital infrastructure, along with wireless networks and “smart” devices connected to the internet, from phones to security cameras to fridges.

“When public policy people talk about investments in digital infrastructure they’re usually talking about improving network connectivity or broadband connectivity,” Ramanathan said.

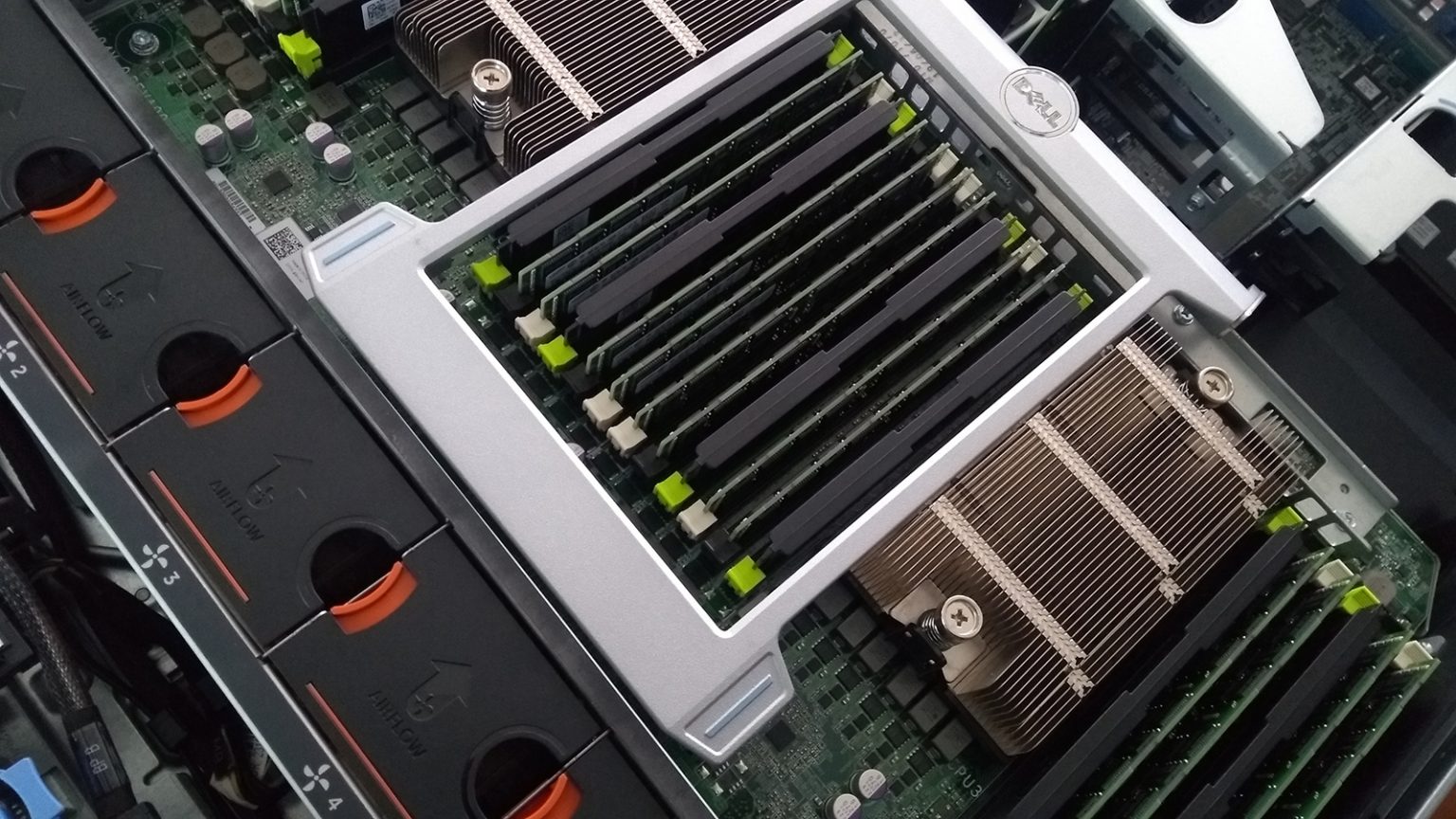

These investments require physical hardware, ranging from the sensors installed on cell towers to the servers at the heart of the mammoth cloud-computing data centers. Indeed, previous reporting suggests Foxconn may be looking to assemble servers for cloud computing in Mount Pleasant.

A November 2020 Bloomberg report, citing unnamed “people familiar with the matter,” revealed that Foxconn had landed a deal to assemble server components for Google to use in its cloud-computing business. According to the report, assembly of the server components was set to begin at Foxconn’s Mount Pleasant campus during the first quarter of 2021. However, neither Foxconn nor Alphabet, the parent company of Google, has publicly confirmed such a deal, and it remains unclear well into the second quarter of 2021 if this type of work is happening in Wisconsin.

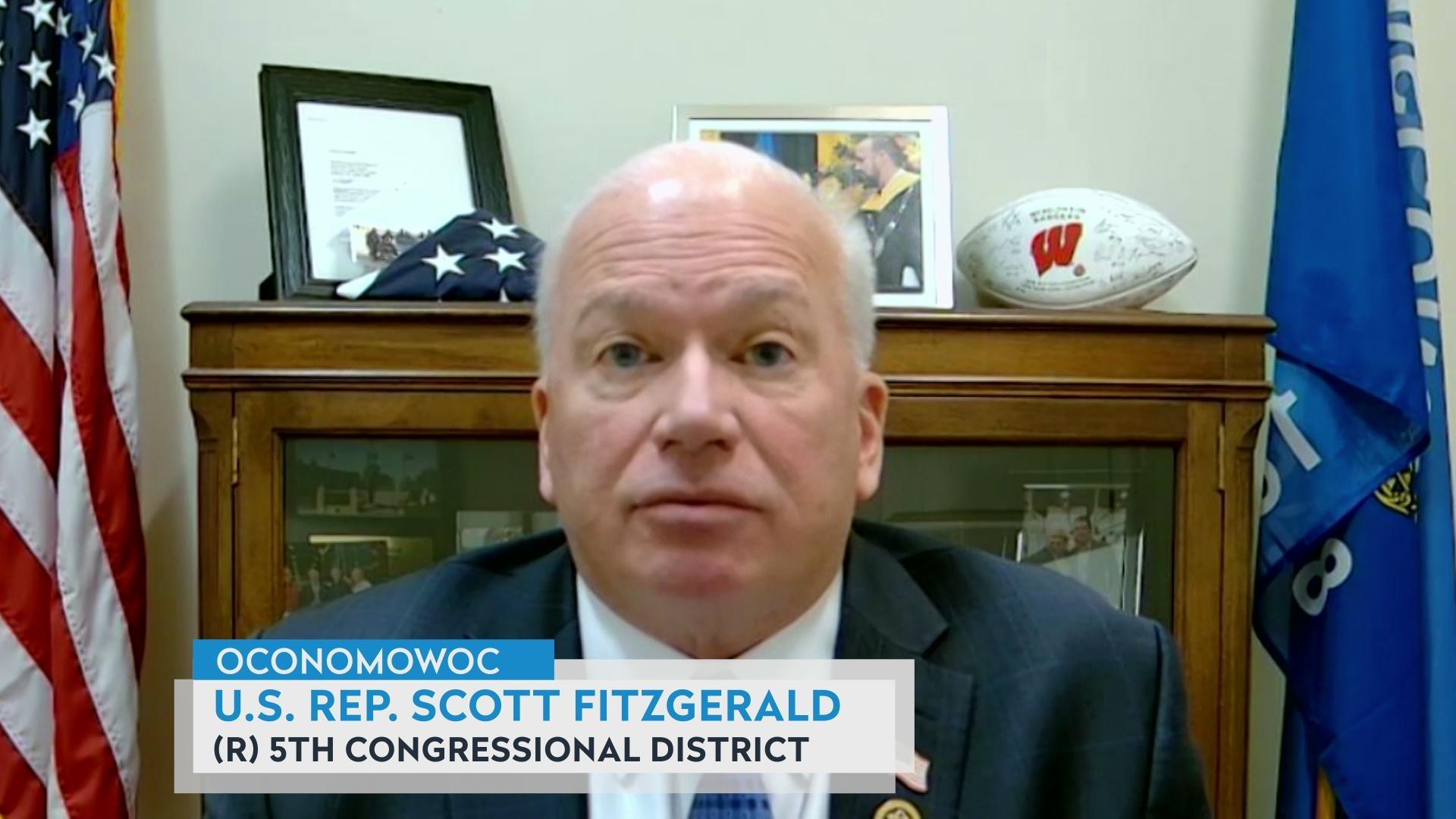

In an April 30 interview on Here & Now, Wisconsin Economic Development Corporation Secretary and CEO Missy Hughes did not mention any specific contract between Foxconn and another company, but she did describe witnessing operations in Mount Pleasant consistent with server assembly.

“What they’re doing right now, what I’ve been able to see firsthand, is building high-tech data servers, and they have put in assembly lines to do that,” said Hughes. “They are building those for a number of different companies. And they will continue to be able to be flexible and build other types of products for other companies and really use their expertise.”

Ramanathan described the types of servers Google uses in its cloud-computing business as “high-end” pieces of digital infrastructure hardware, with the cost for an individual server running tens of thousands of dollars.

Tom Still, president of the Wisconsin Technology Council, said he has been unable to verify whether Foxconn has landed a deal to assemble Google servers in Wisconsin, but that doesn’t mean such a deal doesn’t exist.

“It’s such a competitive business that I can imagine either side in those kinds of relationships would not want to talk openly about it,” Still said.

He added that server assembly, whether for Google or another customer, would certainly qualify as digital infrastructure hardware production.

Further, Still described digital infrastructure hardware as a broad and evolving term of art.

“It can touch everything from servers to motherboards to data center infrastructure, outward communications tools, cybersecurity and environmental mitigation,” Still said, noting a growing market for products that can reduce the environmental impact of data centers in particular. Server farms use huge amounts of electricity and water.

With cloud computing becoming increasingly central to digital life, Still said the need for new data centers is expected to be strong well into the future. That means the market for high-end servers will likely remain strong too.

“There is a huge appetite for data centers here and elsewhere,” Still said, adding that he believes Wisconsin is an attractive place to site them.

“We don’t have earthquakes or hurricanes that take those things down,” he said. “We’ve got more reliable power … and I think we’ve got the technology infrastructure and the workforce in Wisconsin to help build them.”

Still and Ramanathan said the market for digital infrastructure hardware is likely to expand for years as more people gain access to the web through internet-connected devices. Investors agree, with a North Carolina-based capital management group forecasting that rising demand for “digital connectivity” will feed demand for data centers, cell towers and other digital infrastructure hardware.

Whether or not Wisconsin attracts new data centers, Still described a newer trend among American technology companies toward “onshoring” or “reshoring” parts of their supply chains to the United States. The COVID-19 pandemic has only accelerated the trend, he said. Foxconn’s Mount Pleasant facility could be well-positioned to reap the benefits of this strategic shift, Still said, with the assembly of server components being a part of the digital infrastructure supply chain ripest for reshoring.

Foxconn’s deep business connections in East Asia, where much of the world’s digital infrastructure hardware is currently manufactured, could also help it source components it would need to assemble servers in Wisconsin, leading with computer chips. The vast majority of silica-based computer chips are manufactured in China. However, both Still and Ramanathan considered it unlikely that the manufacturing of chips from raw materials would happen in Wisconsin, or the U.S. in general, on a large scale any time soon.

“That would be a huge investment,” Ramanathan said. “Hundreds of billions probably.”

Passport

Passport

Follow Us