[dramatic music]

The following program is a PBS Wisconsin Original Production.

–Home ownership is regularly regarded as a milestone act that can also serve as a key to wealth building and financial stability for families. The dream of home ownership, however, has historically not been equally accessible based on race and the legacy of systemic racism on home ownership and its impact remains today. On this episode of Why Race Matters, we’ll talk with a realtor and recent homeowner about racial disparities and home ownership. But first, let’s learn about Why Race Matters when it comes to owning a home.

Homeownership has been described as a core component of the American Dream. The National Housing Act of 1934, signed by President Franklin D. Roosevelt, founded the Federal Housing Administration or FHA to improve housing conditions during the Great Depression. This access did not extend, however, to Black and other historically marginalized groups. And instead furthered housing discrimination through a policy known as redlining, marking in red on government-sponsored maps where Black and other communities of color lived or lived nearby. This indicated to appraisers that these neighborhoods were too risky to insure mortgages.

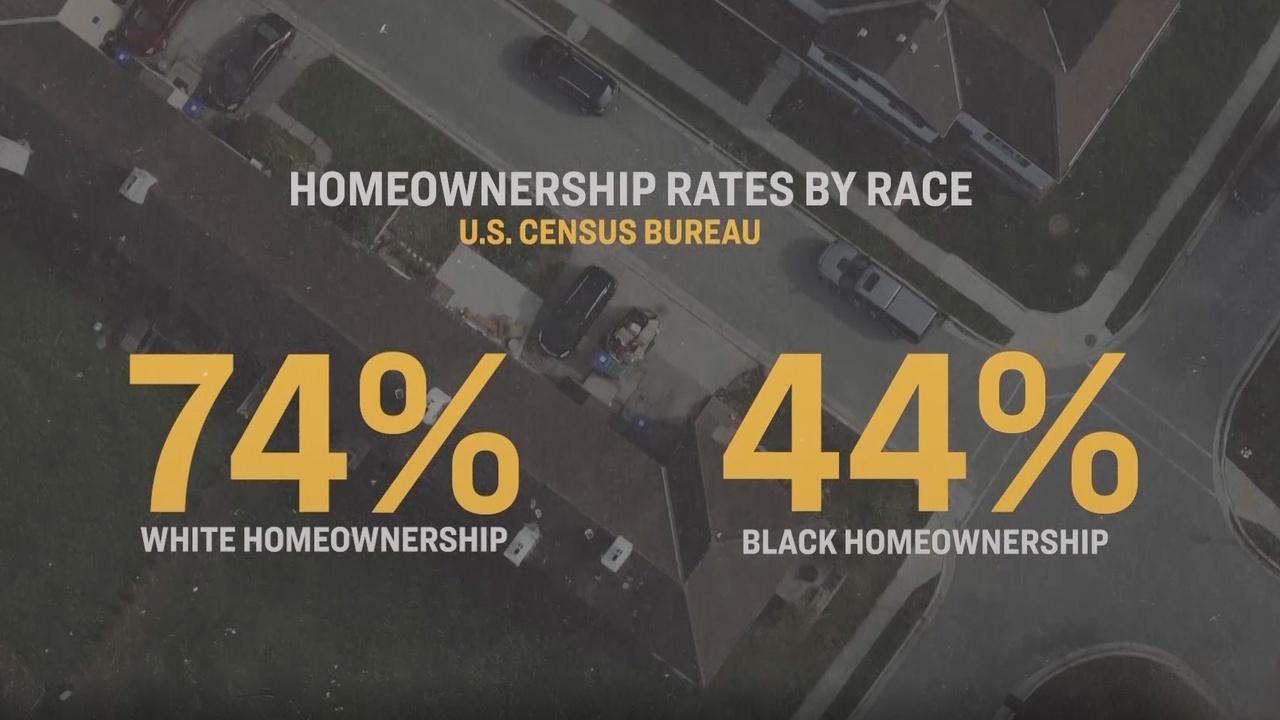

At the same time, the FHA subsidized the production of new suburban communities for white families with the requirement that none of the homes be sold to Blacks. This meant Black families and other families of color were relegated to urban housing projects. The Fair Housing Act of 1968 sought to end these discriminatory practices, but the legacy of redlining remains. In the first quarter of 2022, The national home ownership rate for white families was approximately 74% compared to 44% for Black families. The racial home ownership gap is even greater in Wisconsin and it continues to grow. Despite these glaring disparities, there are efforts underway to address home ownership inequities. We’ll hear from realtor Tiffany Malone and new home owner Myesha Thompson about their experiences and this important work. Well, thank you, Tiffany, Myesha, for joining us for our exciting conversation today.

– Yeah.

– Thanks for having us.

– Thanks for having us.

– Tiffany, we’ll start with you. So can you tell us a little bit about the work that you do and what’s the climate of home ownership like currently in Madison?

– So, I’m a realtor here in Dane County. I’m employed at the Alvarado Group. I’m also the co-creator of a down payment assistance fund called “Own It, Building Black Wealth.” And I’m on a few boards for affordable housing because I think that’s needed in Dane County. But my current role as a realtor is educating other clients, as well as helping people find homes every day. And it’s been great, but there has been some challenges being a Black woman in Madison, as well.

– So, what are you seeing with your clients, but also, I guess, yourself navigating that professional space?

– So. for my clients that don’t have a million dollars or don’t have $500,000, they’re getting priced out because we have a lot of demand and not enough supply. And if you don’t have help or funds from friends or family, I don’t even wanna say friends, but family, because family gifting is allowed, but for your friend to give you $10,000, that is not allowed. So if you don’t have funds from family, you know, that’s hard because you have to come up with 20% down if you have a conventional loan or 3.5% down if you have an FHA loan. But right now in this market, that’s considered a risky loan. So the average seller would probably take the conventional rather than the FHA.

– Okay, and that’s the 20%.

– Yep.

– Okay. And so, give some context for those who may not know the average cost of things here. What are you seeing as the average cost of home purchase during this time?

– A three-bedroom, two-bath in Dane County is about $350,000.

– So, if I’m doing the math, 20% of that is 60K, right?

– Yep.

– So, how many people have like $60,000 around to compete, right? Because I understand just because a house is being sold for that amount or listed for that amount, it may not actually be sold for that amount.

– Correct, there can be a house listed for $350,000. There could be 10 offers on that house, but the seller will take the strongest offer, meaning the offer that has the least contingencies. So, let’s say I had a client and they wanted to put an offer in on this house that was $350,000. I would ask them what is their max? How much cash do you have to cover if you offer over asking? So if you have $20,000, $30,000, you could put an offer in for $370, $380, but you have to have the documentation stating that you have the additional $30,000 in cash to cover that over the price asking. A lot of people, they don’t have that. So for the folks who do, good for them, because they can get a house, but for the folks who don’t, it’s gonna take you a little bit longer to get a house.

– Wow, and are there a ton of like low-income or kind of diverse housing options for people who don’t have the money needed to compete in the conventional housing market?

– Not currently.

– Okay.

– I work with a lot of families who receive Down Payment Assistance or DPAs from the City of Madison or from the county. And it’s very challenging to get an accepted offer right now for those people because those are considered risky offers, even though it’s not a risky offer, but because of the contingencies that come along with it, so you need an extra inspection. Why would I take your Down Payment Assistance that you need an extra inspection for, if I have this other offer that’s clean and it’s cash, or it’s a conventional loan and it’s $30,000 over asking. I’m probably gonna take this one and not this one.

– So that’s super interesting. ‘Cause I feel like those programs are marketed as like, this is the way to level the playing field in terms of home ownership. It’s these programs, it’s these forgivable loans, but for a seller who’s like, I mean, that’s nice and everything, but I have all these other people that I could also consider. Why would I take everything that comes along with what you’re offering to me?

– And they’re restricted because they’re federally funded. I mean, there’s federal funds that go along with it. So, without that, you could probably have less restrictions, but because of that and it’s education, as well. So if you have a homeowner that doesn’t know about these DPAs or Down Payment Assistance grants and their agent that’s listing their house, doesn’t inform them, this is what this is, the money’s allocated for. It’s just one extra inspection and it’s not hard or it’s not, it’s like, make sure the light bulbs are working or the smoke detectors are in. It’s nothing too serious. maybe that seller would actually take that offer. But because nobody really explains, then it’s like, let’s go with the easiest and the cleanest offer.

– And as a result, we are not seeing the housing disparity, the home ownership disparity get closed at all.

– Correct.

– Okay.

– Because it’s harder for those minorities that do have this Down Payment Assistance. For those that do have it, I mean, it’s just hard.

– Okay, well, I wanna circle back to some more expertise from you about what can we do about that issue, but Myesha, on the other hand, you are a success story in terms of someone who’s navigated the system.

– Yes.

– And has become recently a homeowner in Madison. Congratulations.

– Thank you.

– Can you tell us a little bit about your story?

– Yes, I actually built my home. I love my house.

– Mm-hmm.

– But I would have to say as a person of color and having a realtor who is a woman, and a Black woman at that, we encounter a lot of… A lot of things I feel like we wouldn’t have encountered some of those things if we weren’t Black women. Although I met the requirements, I had the money, I qualified. We were given a lot of pushback on a lot of things, even to the extent of, like, some of my rights being taken away as far as like the builder trying to make decisions on my behalf, as if they are the ones that’s paying for the house to be built. So I found myself over-advocating for myself a lot throughout the process and Tiffany, as well. But if I had to go back and do it over, I wouldn’t change it ’cause I learned a lot.

– Mm.

– I learned a lot.

– What’s one of the biggest lessons that you learned from that experience?

– I feel like there’s this stigma out there that, as Black women, we are– we’re loud, we’re aggressive, or if we’re not loud and aggressive, they expect us to sit there and be quiet and allow whatever to occur with no voice. When making an investment like building a home, whether or not is for personal or investment properties, be your voice, have a voice and use your voice and don’t be afraid to use your voice.

– Wow. I love that because when encountering that sort of process and there’s like so many new terms and there’s like a lot that you have to do and it can feel very intimidating.

– Absolutely.

– If you’re a first-time home buyer who doesn’t come from a background where you’re taught how to navigate the ropes.

– Absolutely.

– It could be easy to feel as though you can defer to someone else’s expertise and that your voice is secondary.

– Absolutely.

– But in doing so, you can be taken advantage of, or just maybe not get the best deal, because like you said, you’re not advocating for yourself.

– Absolutely.

– So I appreciate that. There are things out there that it sounds like are designed to empower communities like ours, to understand how to navigate the process if that’s a pursuit that home ownership is of interest to them. Are there things that you use in the community or that Tiffany you interact with in the community that help people understand the basics of home ownership and how to pursue?

– Currently, I co-facilitate a couple of classes for “Own It, Building Black Wealth” that’s partnered with One City Schools. So, even if you’re not ready, you’ll learn about credit. You’ll learn about budgeting. You’ll learn about agents. You’ll learn about life insurance. So we educate lots of families in regards to that. But I always tell families, always ask questions. There’s no question that’s stupid because if you don’t ask the question, you won’t know the answer.

– Right.

– Now, I always say don’t sign anything… if it’s foreign to you, don’t sign it.

– Right.

– Because historically, we’ve been forced to sign a lot of stuff and we don’t actually understand what’s on the paper.

– Myesha: Absolutely.

– So, I’m like always like, if you have to read it 50 times to understand it, do that. If you have to call me and I’m not explaining it to you correctly, I’m gonna call somebody else and say, hey, can you please ex– because you don’t know what you don’t know.

– Angela: Right.

– And I don’t want you to get into a position where you will regret what you just did.

– Absolutely. I grew up on the south side of Chicago. Our school system was obviously very different from Wisconsin’s school system. We didn’t learn a lot. We didn’t have books. My family wasn’t in a position to educate me on things such as life insurance and credit. And I feel like as we learn these things, we should share it with our community and educate them. Because just like my family wasn’t in a position to educate me, I’m pretty sure there’s thousands of other families out there who just lack the knowledge to be able to teach their families this important thing ’cause it’s very important. We need to understand the “whys” behind why we’re doing what we’re doing.

– I love that. You all are speaking music to my ears. I am someone who’s super passionate about financial literacy. Even though I get there are some challenges with how that industry operates and the assumptions that it makes about people.

– Myesha: Yes.

– Because actually, poor people don’t need to not go to Starbucks every day. Like, that’s not a poor people issue. The issues with people in poverty are very different from those in the middle class. But I agree that there are some maybe foundational things that are necessary before you even get to the point where you’re going through the home purchasing process and interacting with a Tiffany to, like, go to showing some things like that.

– Myesha: Absolutely.

– So I guess what advice would you have for folks, particularly from our communities, other historically marginalized communities who are like, man, I’m just trying to get started with the basics. Like, what’s a basic way to get started to position yourself, to be competitive in a housing market like Dane County’s.

– Tiffany: I’d say number one is budgeting.

– Myesha: Absolutely.

– Tiffany: Find out where you are on paper.

– Angela: That’s a four-letter word. Because once you write down those bills, what you have coming in and going out. Like, you check yourself real quick, and you’re like, did I really spend $500 this month on fast food? You, like, check yourself in the door.

– Yeah.

– So, like, you don’t, I don’t think people really know how much money they have until they put it down on paper.

– Myesha: Absolutely.

– Because it looks like you’re making $35 an hour on paper.

– Angela: I’m good.

– Tiffany: But taxes, insurance. That’s like nothing after the fact. And then you look at everything on your spreadsheet and you’re like, I gotta do better.

– Angela: Wow.

– Tiffany: But if you can budget and then start saving, that puts you ahead. And if you have blemishes on your credit, if you speak with somebody like a lender ahead of time, Hey, I really wanna buy a house, but I don’t know where to begin. Can you show me where I’m at, what I need to do? Then, you can start knocking down whatever you need to knock down and putting more money away. But unless you check yourself first and realize how much money you have and what you’re doing to yourself, like, it’s just gonna be a revolving like circle, like, over and over, like a hamster wheel. Growing up, I wasn’t taught that. My mom bought everything in cash. She had a checking account and she wrote checks like it was no, hey, let me get a credit card or let me, it was just cash.

– Angela: Yeah.

– So, my mom never owned a house. She rented her whole entire life. But I think back that if somebody taught her that, that she would’ve been in a different situation. And my mom worked until she was 72 years old.

– Angela: Wow.

– She always had a job.

– Tiffany: You can learn about your credit and learn about all these awesome things that you can get utilizing your credit, but you can also quickly damage it.

– Tiffany: But it’s the person educating you on how to use that credit card.

– Myesha: That’s right.

– Tiffany: Don’t use more than 30%. Pay it off in full at the end of the month. Like, it’s just, I’ve always taught my kids. It’s just like cash.

– Angela: Right.

– Tiffany: Absolutely. So if you spend $500 on your credit card, just make sure you’re gonna pay that off in four weeks.

– Myesha: Absolutely.

– Tiffany: Because you’re borrowing from yourself, don’t borrow something you can’t pay back.

– Myesha: Absolutely.

– And if you don’t understand that or know that concept, you could be damaging yourself.

– Myesha: Absolutely.

– But, then again, who teaches you that, right?

– Myesha: Right. [laughs]

– Angela: Well, hopefully, parents like yourself are like, “This is how to do it.” So you don’t start off at 18 with a ton of mistakes that you have to clean up later in life. But you’re right. For a lot of us, we just kind of learn on the fly.

– Yeah.

– Angela: You learn as you go. And, hopefully, it’s not too catastrophic.

– Myesha: Right.

– Because if you do have that home ownership goal, you don’t want that to be the thing that holds you up, because you may have the cash or other things, but it’s that credit they’re like, “Ah, I don’t know if I’m gonna trust you.”

– Myesha: Yeah.

– Pay that mortgage back ’cause you didn’t pay this or what have you.

– Tiffany: Exactly.

– So yes, I do appreciate you all uplifting those kind of foundational pieces that apply to any money move that someone could choose to make, even if home ownership is not the path for them.

– Myesha: Absolutely.

– But one aspect of home ownership I did wanna touch on a bit ’cause I think it is relevant to considerations for our state, for people who are considering becoming homeowners in our state. And that’s kind of the safety piece, like, what that means when you’re looking for homes and things like that. Because compared to other cities, you mentioned you’re from Chicago. Like, you may have the option of like, okay, this is a home in a community where people look like me. Like this is, this is my community. I feel safe.

– Myesha: Right.

– No biggie. In a state like Wisconsin, that may be a little more difficult. I don’t know about you all, but I’m on the NextDoor app so I see, you know, the commentary.

[laughs]

– Myesha: Yes.

– Coming through on that app. And I’m like, “Okay, this is interesting combo, but it gives you insight into what people in your neighborhood are paying attention to, what alerts them, when they’re calling the police.

– Myesha: Yeah.

– So, I know for me that was a central concern when I was home shopping in Madison. Cause I’m like, man, where would I feel safe for me and my family versus, because we’re here that alerts our neighbors and leads to a heightened, like, police presence.

– I would say in that NextDoor app, I do see a lot of the verbiage on there as well. I don’t comment or say anything because it’s like going to war with whoever’s on the other end of the screen. But I would say if you feel, if you see somebody that’s walking in your neighborhood, that doesn’t exactly look like you, or you’re wondering what they’re doing there, I would say be neighborly and go talk to that person or say ‘hi’ to that person.

– Myesha: Yeah.

– I have been in situations where I’ve parked in front of houses, waiting for my clients in different cities and neighbors have asked me, what am I doing there? Because I’m the only Black person on the street parked in the car. Like, I mean, that’s what happened.

– Coming from a more diverse city setting, I have felt unsafe by virtue of looking around and seeing like, oh, okay. So that has made me, and then, kind of how I was reacted to as a result made me feel unsafe.

So, but like I said, that was part of the driver behind my interest in communities

where I would– Hopefully, there’d be a lessened chance of like my family, kids walking on the street, not alerting neighbors to call the authorities, that sort of thing. And that hasn’t been the experience, thankfully.

– Tiffany: Good.

– Myesha: Yeah.

– Yes, we don’t need that.

– Myesha: Yeah, we don’t.

– Tiffany: I like to say, too, is that a lot of homeowners or Black and Brown people don’t understand that for some Black and Brown people, it’s more difficult to buy a house. Historically, we are where we are because of what happened for redlining and the GI Bill and everything. So, we’re a little bit behind than the average homeowner. And I think that a lot of people are down on themselves because of that. But there’s a reason because of that. So I say this all the time to people, there’s a reason why you don’t know this or…

– Myesha: Right.

– And that’s why I think it’s so important to have, like, the two of you here being the faces of this topic because you’re right, because of things that have happened historically, it’s easy to internalize that as a “me problem.” And so, then, I think I can’t do certain things because of the state of my life, maybe the lives of others who look like me, when it’s not necessarily a “you problem,” not to negate your personal responsibility.

– Tiffany: Correct.

– But historically, there are things that happen way before you that have influenced the likelihood of you being able to easily do things or not. So, thank you for bringing up those historical pieces.

– Yep, it’s the systems that, this is why we’re here because of the systems.

– Yeah.

– Absolutely.

– But you can beat the system.

– You’re an example.

– Absolutely, if the system had its way, I would not be sitting here. I would not. My life would not be what it is, but it goes back to that mindset, wanting to break those generational cycles and wanting to build that generational wealth and along with that is healing from that trauma. I think our community mental health, now it’s becoming more of an important topic, but before, it was not. Tapping into that and allowing yourself to heal and become whole is also important because, in real estate, we don’t see a lot of people that look like us. So, we’re gonna come across people who’s gonna talk down on us and they’re gonna have their “superior” hat on a lot.

And you gotta know how to control– not control, but maintain who you are, know who you are and not let something like that get to you because we experienced it a lot. At least for me, I won’t speak for Tiffany. At least for me, I experienced it a lot. And sometimes, it made me angry. Sometimes, it inspired me to just be like, “You know what? “I’m gonna go more. “I’m gonna make you so mad because I’m gonna do this. I’m not gonna stop, you know.” But everybody can’t do that. So, but yeah, it all goes back to, like you said, our history.

– And I think, yeah, I don’t wanna say like, “It’s okay,” but I’m used to things like that happening. So, I’m a lot calmer.

– Yeah.

– Because sometimes you can expect it or sometimes, it’s like you’re completely silent.

– Things like Myesha’s experience?

– Just like somebody talking down on you because you are a woman or because you are a Black woman or thinking that they’re smarter than you, or you don’t know what you’re talking about.

So, you have to let them say whatever they wanna say, and then, you rebuttal, or, “Are you finished yet? Because I can hear you, but I’m not receiving what you’re saying right now.”

So, it’s like, “I’m not gonna get on your level to be whatever,” but just know your truth.

– Yeah.

– Yeah.

– And that goes back to educating yourself.

– Yeah.

– So, if you educate yourself, like, you can rebuttal like that and nobody can tell you. [snapping fingers] Yeah.

– Yeah.

– Is there anything we didn’t touch on today that you think it’s super important that we discuss or at least bring up related to home ownership or just the topic of disparities and wealth building? Anything like that?

– I would say my thing is that what I tell people all the time is, “Don’t take the first no.” You’ll get a no. Maybe a bank will tell you no. If a bank tells you no, go to a mortgage company. But keep on going until you get your ‘yes.’ And keep asking questions. Because a lot of the time, you won’t get the answer that you seek, but you’ll get to that one person who will let you know what you need to know. So, don’t take no for answer, but keep going. And don’t feel ashamed when you’re denied.

– Angela: Right.

– Because that’s only temporary. Eventually, you’re gonna get your home or whatever you’re seeking.

– Myesha: Yeah.

– And I see a lot of people that turn away after that first initial meeting with the mortgage lender and they’re like, mm, alright. But no, it’s not. Keep going. Don’t stop.

– Wow.

– Yeah, I agree. That’s a good point. I got three “no’s” before I got my “yes.”

– See?

– And with those three no’s, they didn’t bother to tell me what the issue was.

– Angela: They just said no.

– They just said no. And I started to get angry. And I was just like, no, I can’t give it that energy. So I projected it onto learning, “What could be the issue?” So I would just have to say, if you do get those “no’s,” take it as motivation.

– I love that.

– ‘Cause that actually was like my story when I started off in home ownership. Like, I got a couple of “no’s” before I got a yes. And that was 12 years ago.

– Did they tell you why?

– Angela: No.

– Myesha: Of course not.

– And I didn’t know to ask.

– Tiffany: Right, cause you don’t know.

– I moved on, right. But yeah.

– I bet you it was something so little.

– Yeah, sometimes even when you ask, it’s not even really an issue, like one of the lenders for me, when I asked why and she gave her reason why, and I went to the other lender who gave me a “yes.” And she’s like, “Are you serious?”

– At the reason that you were denied before.

– Yeah, the reason, yes. She’s like, “Are you serious? Everyone has student loans.”

– Thank you, this has been a great conversation. I feel like we could keep going.

– Yeah.

– I don’t wanna monopolize the rest of your day. But thank you all so much for taking time out of your day to talk about this important topic. You all are in the community. So I hope folks that are watching this will seek you out if they have questions or, like you said, wanna network.

– Yes.

– To learn more, yeah.

– Thank you.

– Thank you.

– Myesha: This was great.

– Government-sanctioned redlining has had a lasting impact on Black and communities of color and contributes to the disparities in home ownership that are experienced nationally and even more so in Wisconsin. This reality presents the opportunity for our state to interrogate our housing practices and implement change. Black realtors and other advocates of equitable home ownership work to provide education and challenge policies and practices, making that slice of the American Dream more attainable for all. Watch additional episodes at pbswisconsin.org/whyracematters

[upbeat music]

– Announcer: Funding for Why Race Matters is provided by Park Bank, Cuna Mutual Group, Madison Area Technical College, Alliant Energy, UW Health, Focus Fund for Wisconsin Programs, and Friends of PBS Wisconsin.

Passport

Passport

Follow Us