'Here & Now' Highlights: Charles Franklin, Kirsten Johnson, Mary Triggiano, Melody Harvey

Here's what guests on the April 29, 2022 episode had to say about voters' inclinations four months out from Wisconsin's partisan primary, how COVID-19 cases are rising again in Milwaukee, what millions of dollars of pandemic relief funds will mean for criminal courts and what happens when people borrow money from payday loan operations.

By Frederica Freyberg | Here & Now

May 2, 2022

Frederica Freyberg and Charles Franklin (Credit: PBS Wisconsin)

Horse-race polling in Wisconsin with months to go before the August 9 primary election show few surprises – but perhaps incongruously – voter enthusiasm in 2022 is higher among those least confident about the 2020 election, according to April responses to the Marquette University Law School Poll. COVID-19 cases have tripled in the last month statewide and Milwaukee is seeing its own spike, though hospitalizations and deaths are not similarly surging, Milwaukee Health Commissioner Kirsten Johnson shared. A pandemic-driven backlog in felony cases has courts across the state digging out, but an infusion of federal money offers hope, explained Milwaukee County courts Chief Judge Mary Triggiano. A Pew Charitable Trusts report showed that Wisconsin is one of seven states that has no caps on interest rates for payday loans – UW-Madison consumer science professor Melody Harvey described what happens when a borrower fails to repay such loans.

Charles Franklin

Director, Marquette Law School Poll

- Republicans who are least confident in the accuracy of the 2020 election are more enthusiastic to vote in 2022, while those most confident in the election result are less enthusiastic to vote, according to polling released on April 27.

- Franklin: “That’s within the Republican Party, and it has real implications for the primary and perhaps for the general. Those least confident are like 20 points more enthusiastic about voting than Republicans who are confident in the election outcome. Well, that probably means that the primary voters are going to be more heavily tilted towards those skeptical of the election. And you see candidates having to deal with that in their campaigns. But it also means that maybe those Republicans who don’t agree that the election was stolen may not be as enthusiastic about supporting an election-skeptical candidate who carries that into the November election. So this is something worth watching about how this division within the party, and about a third of Republicans again are pretty confident. Does that hurt them in the fall, even if it means in the primary skeptics have the upper hand?”

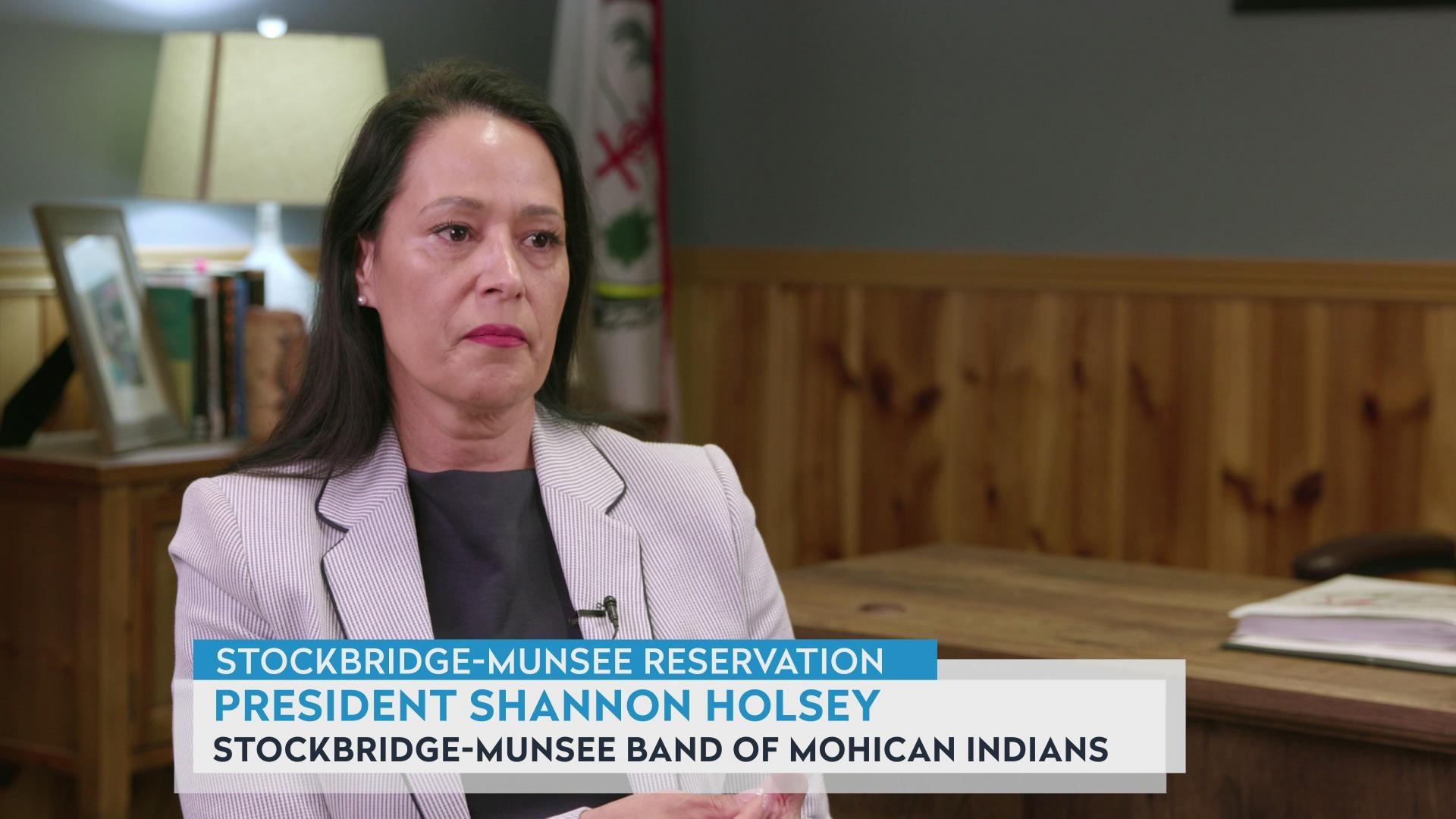

Kirsten Johnson

Health Commissioner, City of Milwaukee

- As is happening across Wisconsin, COVID-19 cases are once again increasing in Milwaukee, which has seen “significant increases over the past two weeks.”

- Johnson: “I think what’s most important to realize is that covid is here with us, that there is risk, that you have to evaluate your own risk, but also comparing that to what we experienced in December and January. And it is nothing compared to what we saw in the middle of the surge… But I think the message is we know how to live with it. We’ve learned a tremendous amount over the last two years. We know that if you’re at higher risk, you need to be more cautious. We know people and people know their own level of risk and their comfort with risk. We know there are children who have not been eligible for [a] vaccine that we anticipate that’s coming in during the summer. But I think it’s really identifying what your level of risk is, as an individual, for your family, and then measuring that against the activities you engage in and knowing again that there are many things we can do. I can put on a mask. We can socially distance. We can test before we gather with friends or family for a large gathering. So we have tools that we didn’t have previously.

Mary Triggiano

Chief Judge, Milwaukee County Circuit Court

- Wisconsin has a felony case backlog of more than 17,000 cases in the courts as of April 25, 2022, with more than 1,600 of them in Milwaukee. The pandemic closed down courthouses and delayed cases from being heard, and they kept on stacking up even as conditions eased. Wisconsin is using more than $30 million in federal pandemic relief funds to help hire attorneys, clerks and court reporters to catch up on these cases. In Milwaukee, more than $14.5 million will go toward staffing five new courts, including a night court. The Chief Judge said this money is welcome.

- Triggiano: “I think it provides some level of hope. I mean, everyone knows that we want to provide fair, equitable and timely justice. And the backlog is weighing pretty heavy on everybody. The judges are working as hard as they can to get these cases moving. The prosecutors, the district attorneys, the public defenders, the court reporters and deputy court clerks are all pitching in, trying to figure out how to move cases as quickly as possible. So having this investment gives us an opportunity to restore some, I think, equilibrium to our court system so that we can advance justice at a pace we all believe is reasonable. I think everyone really have some hopes about this money coming in.”

Melody Harvey

Professor, UW-Madison Dept. of Consumer Science

- An April 2022 policy brief from Pew Charitable Trusts found Wisconsin is one of seven states that does not cap interest rates on payday loans. Pew showed that Wisconsinites pay an average of $395 in fees when repaying a $500 loan over four months – an interest rate of 338%.

- Harvey: “Payday loans are designed to be short term, as suggested “payday” loans are something that one would rely on in between pay periods – and the general fact that these tend to be small-dollar loans, and so it’s available for a few hundred dollars as opposed to, say, thousands of dollars, than one made per a personal loan or at a bank or credit union. And so given the small dollar amounts, we would like to believe that one would be able to repay those within that two-week time frame. But given the income volatility as well, numerous other shocks may occur, including potential delays in payday that results in rolling over that loan… So if you are rolling over a payday loan, you are effectively borrowing not only for that initial principal, but also the interest in these charges that were accrued from that initial borrowing of the loan.”

Watch new episodes of Here & Now at 7:30 p.m. on Fridays.

Passport

Passport

Follow Us