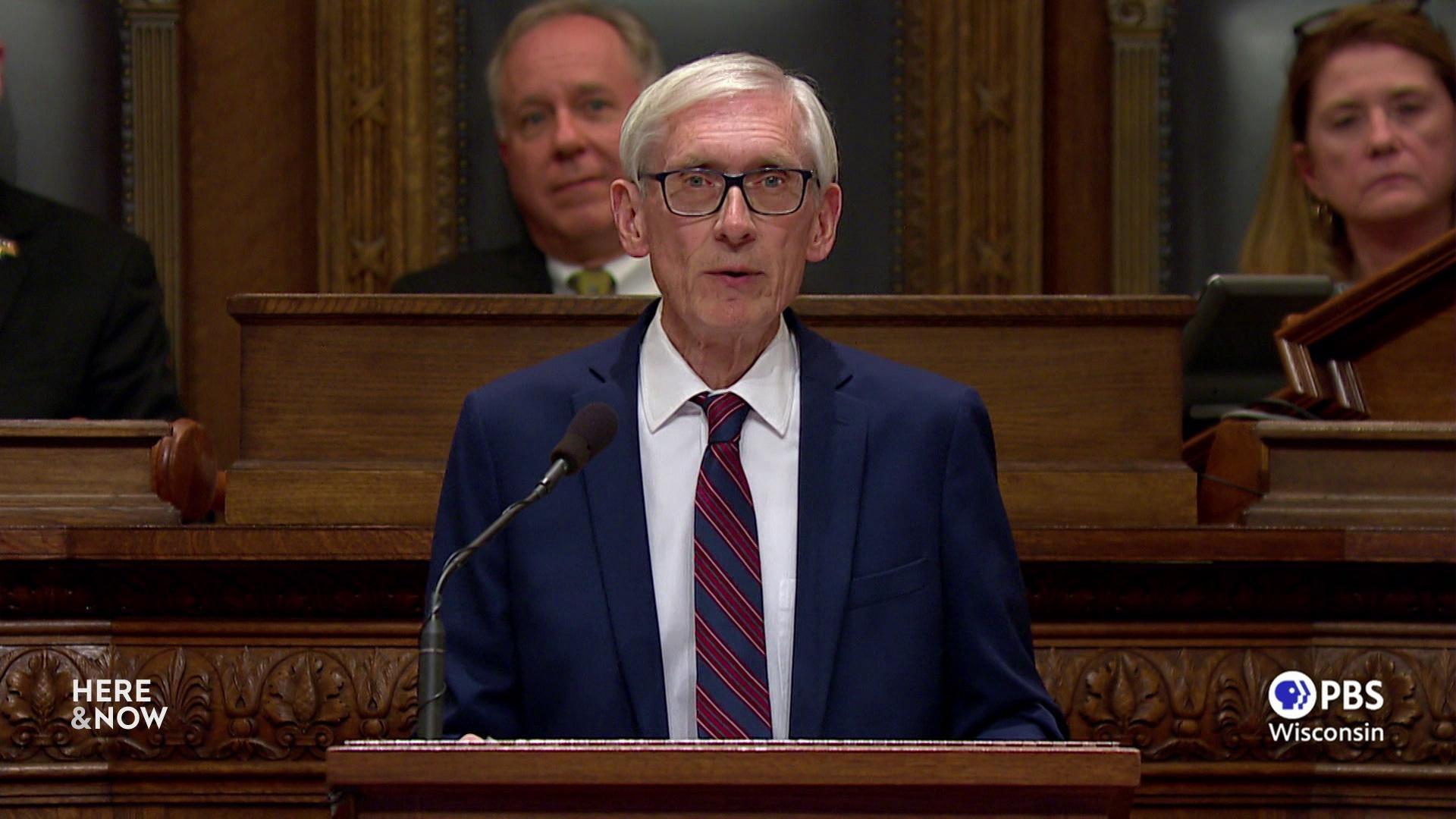

Evers vetoes Republican-backed state income tax cut, credit, exemption bills

Democratic Wisconsin Gov. Tony Evers has vetoed a nearly $800 million state income tax cut passed by Republican lawmakers, along with bills to increase a tax credit for married couples and raise tax exemption levels for retirees.

Associated Press

March 1, 2024

Wisconsin Gov. Tony Evers gives his annual State of the State address on Jan. 23, 2024, at the Wisconsin State Capitol in Madison. Evers has vetoed a nearly $800 million income tax cut passed by Republicans, along with bills that would have increased the income tax credit for married couples and raised the amount of retiree income exempt from the state income tax. (Credit: AP Photo / Morry Gash)

MADISON, Wis. (AP) — Gov. Tony Evers on March 1 vetoed a nearly $800 million income tax cut passed by Republicans, along with bills that would have increased the income tax credit for married couples and raised the amount of retiree income exempt from the state income tax.

Republicans who voted to pass the bills in February said they were designed to make Wisconsin more attractive for families, middle-income earners and retirees. But Democrats said there were better ways to do that.

Republican Assembly Speaker Robin Vos said Evers was refusing to support tax cuts that would benefit the middle class. And Republican Senate Majority Leader Devin LeMahieu called it “unconscionable” to not enact the tax cuts given the state’s $3 billion budget surplus.

Republican Sen. Rachael Cabral-Guevara, the main sponsor of the tax cut for retirees, said the veto was “ot only a slap in the face to our parents and grandparents, it keeps Wisconsin at a disadvantage when they are looking for where to retire.”

Evers has yet to take action on a fourth bill expanding a child tax credit that had bipartisan support. He has until March 5 to sign or veto it.

That measure allow qualifiers to match the state credit to the federal child care tax credit. Currently, qualifiers in Wisconsin can claim only 50% of the federal credit. That means the amount of eligible expenses under the state credit would grow from $3,000 to $10,000 for one qualifying dependent and from $6,000 to $20,000 for two or more dependents.

Evers has generally been supportive of that measure but has yet to commit to signing it.

The veto of the income tax cut was expected as the Democrat Evers has twice rejected similar tax cuts.

The latest bill would have expanded the state’s second income tax bracket so more income would be subject to a lower rate.

Currently, the second bracket covers individuals earning between $14,320 to $28,640 and married couples making between $19,090 to $38,190. Under the bill, earnings up to $112,500 for individuals and $150,000 for married couples would be subject to the 4.4% rate, down from 5.3% now.

Evers, in his veto messages, noted his past support for Republican-backed income tax cuts, including a $2 billion one targeting the middle class that he signed in 2021, but said the latest tax cut was not responsible or sustainable.

“I object to fiscally irresponsible measures that would leave the State of Wisconsin unable to meet its basic obligations to adequately fund education, health care, public safety and aid to local government,” Evers said in the message.

Evers also vetoed a bill that would have increased the income tax credit for married couples from a maximum of $480 to $870.

The other bill Evers vetoed would have increased the amount of retirees’ income exempt from the state income tax from the first $5,000 to the first $75,000 for single filers. The first $150,000 of retired married joint filers would have been exempt under the proposal.

Evers said signing all three bills would have drained the state’s reserves and put it at risk of having to return federal stimulus money. Republicans have rejected those arguments, saying they do not believe the Biden administration would require the state to pay back any stimulus money.

Passport

Passport

Follow Us