Wisconsin's US senators discuss options for compromise on ACA enhanced tax credits

Republican U.S. Sen. Ron Johnson said he's willing to work on legislation to support ACA health insurance customers earning more than 400% of the federal poverty level, with Democratic U.S. Sen. Tammy Baldwin suggesting Congress should consider capping how much people pay.

Wisconsin Public Radio

January 17, 2026

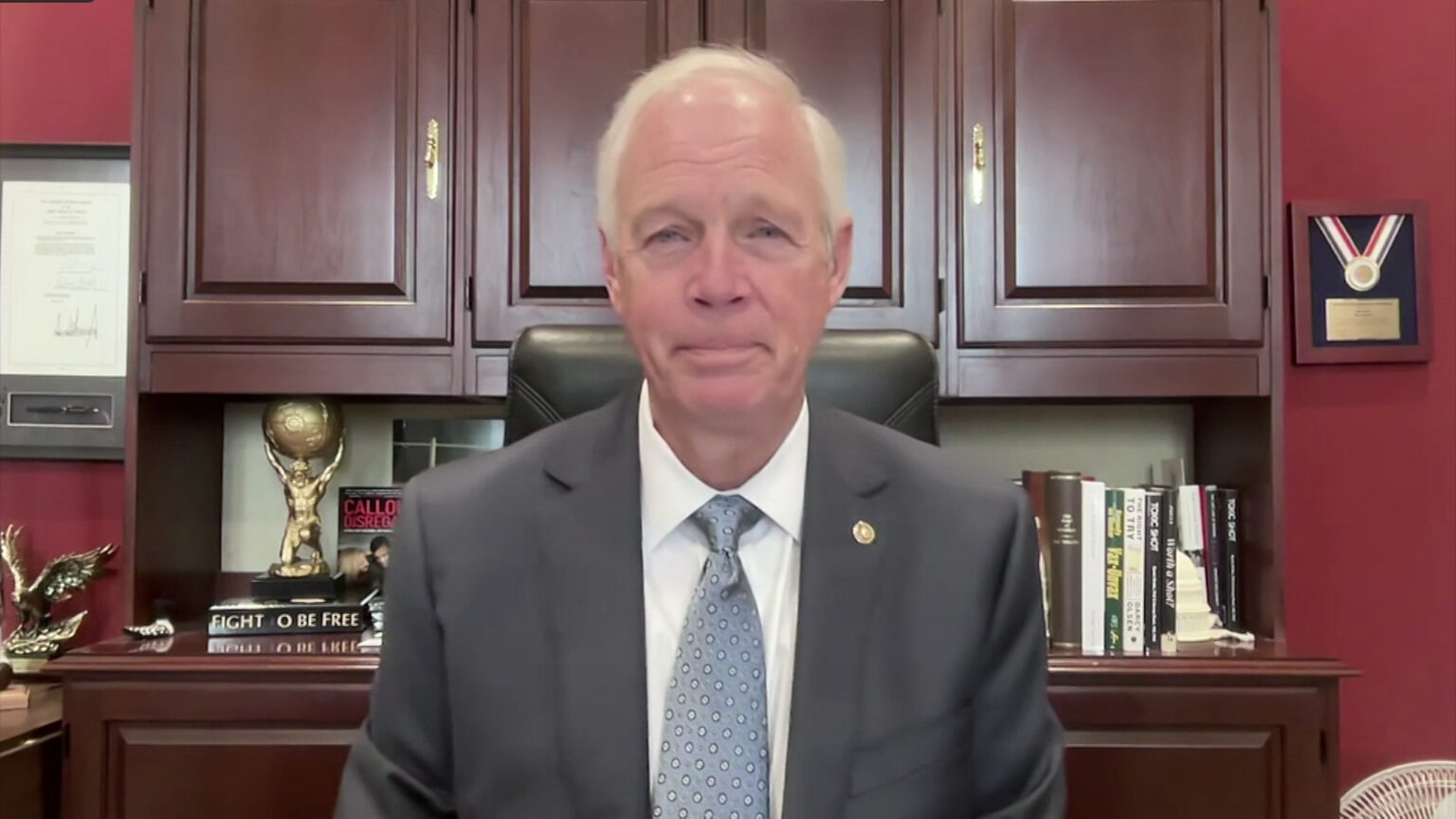

U.S. Sen. Ron Johnson, R-Wisconsin, discusses Affordable Care Act enhanced tax credits in an interview with "Here & Now" on Jan. 15, 2026. (Credit: PBS Wisconsin)

Wisconsin Republican U.S. Sen. Ron Johnson says he’s talking to Democrats about passing some type of assistance for people who lost health insurance tax credits at the end of 2025.

Johnson, who ran in 2010 on a pledge to repeal the Affordable Care Act, has been among the law’s most outspoken critics during his 15 years in the Senate. He remains intensely opposed to the ACA, blaming it for inflating health care costs.

A key element of the law is its federal marketplace, where people can shop for and enroll in health insurance plans. From its inception, the ACA set aside tax credits to help people pay for health insurance, depending on their incomes. In 2021, Democrats passed enhanced health insurance tax credits that increased those subsidies and offered them for the first time to people with higher incomes.

Democrats have tried repeatedly to extend those enhanced subsidies, which were at the center of the political fight that led to the longest government shutdown in U.S. history. Earlier in January, 17 Republicans, including U.S. Rep. Derrick Van Orden, R-Prairie du Chien, sided with Democrats to pass a bill to extend the credits, but it was rejected by Republicans in the U.S. Senate.

In a Jan. 15 interview with Here & Now, Johnson indicated he’s exploring a more limited approach.

“What I’ve been told is there are enough Democrats who will cosponsor that. But right now, I think they’re still holding out hope that they can extend all the subsidies,” Johnson said. “I just believe that’s dead on arrival here in the Senate. We voted that down multiple times during the shutdown. That’s just not going to happen.”

Instead, Johnson said he’s exploring a way to help people earning more than 400% of the federal poverty level, who got cut off when the extended subsidies expired.

“Some of these folks close to retirement are facing premiums of … $38,000 a year,” Johnson said. “So I’d like to help them.”

Johnson said he did not want to restore enhanced subsidies for people at lower income levels, who are already receiving the original tax credits through the ACA.

According to the U.S. Department of Health and Human Services, 400% of the federal poverty level was $84,600 for a family of two in 2025.

Asked about Johnson’s comments in a separate Jan. 15 interview with Here & Now, Democratic U.S. Sen. Tammy Baldwin left the door open to some sort of compromise.

“I believe that there is a lot of room for negotiation on the extension of the Affordable Care Act tax credits,” Baldwin said.

Baldwin said she has a constituent who’s paying 40 percent of their income on health premiums, suggesting Congress should consider capping how much people pay for insurance.

“There is no reason in my mind that we can’t have reasonable income cap or to have a provision that says that you can’t be expected to pay more than a certain percentage of your income on health care,” Baldwin said.

Already, there are signs the loss of enhanced credits has had an effect on enrollment. Nationally, around 800,000 fewer people have selected plans compared to a similar time in 2025. In Wisconsin, enrollment was down by about 17,000.

While Baldwin indicated a willingness to talk to Republicans, she was critical of Johnson and others for blocking a full restoration of the ACA credits.

“We had a moment in the Senate to take up the bill that was passed in the House of Representatives that would have extended the tax credits for three years,” Baldwin said. “And my Republican colleagues blocked it.”

Passport

Passport

Follow Us