Wisconsin Republicans pass $2 billion tax cut heading for a veto by Gov. Tony Evers

The Republican-controlled Wisconsin Legislature has passed a $2 billion income tax cut that's part of a package aimed at lowering child care costs, but Democratic Gov. Tony Evers is expected to veto the plan.

Associated Press

November 15, 2023

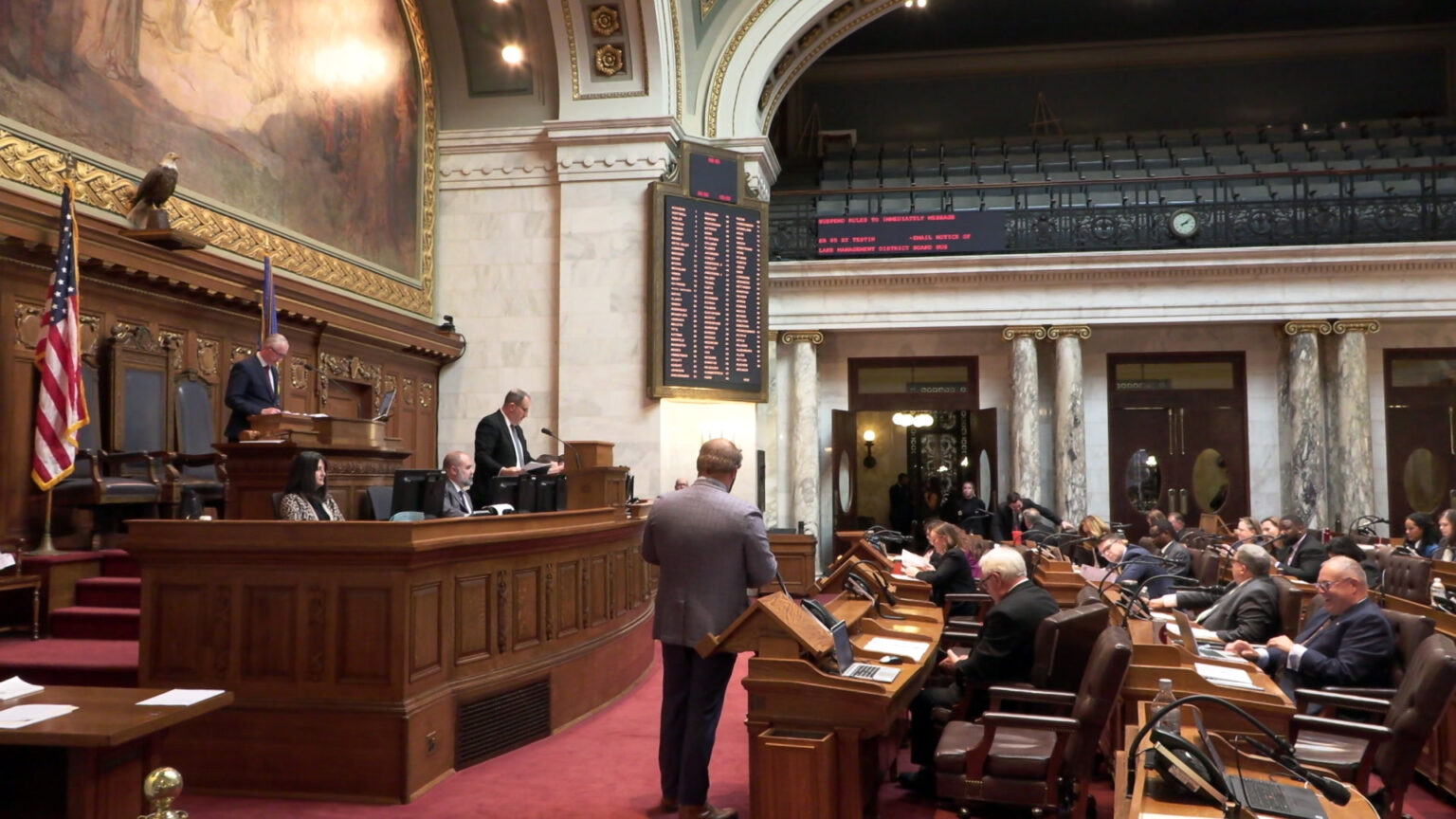

The Wisconsin Assembly holds a floor session Nov. 7, 2023, at the Wisconsin State Capitol in Madison. In a vote mostly along party lines, the chamber passed a $2 billion state income tax cut. (Credit: PBS Wisconsin)

MADISON, Wis. (AP) — The Republican-controlled Wisconsin Legislature gave final approval on Nov. 14 to a $2 billion income tax cut that’s part of a package also aimed at lowering child care costs, which Democratic Gov. Tony Evers is expected to veto.

Republicans gutted a $1 billion Evers proposal to invest in child care he called on the Legislature to pass in a special session in September and instead offered a tax cut in October that Evers has already vetoed. The governor’s spokesperson called the move a “completely unserious proposal.”

The state Senate passed the tax-cut plan in October, and after delaying a vote the previous week, the Assembly gave its approval on Nov. 14 in a 62-36 vote mostly along party lines, sending the plan to Evers. One Republican, Rep. Scott Allen, voted with Democrats.

Evers and Republicans who control the Legislature have battled for months over tax cuts and investments in child care services. The plan Evers called on the Legislature to pass would have allocated $365 million in new child care funding, increased spending for the Universities of Wisconsin by $65 million, devoted $200 million to paying for a new engineering building on the UW—Madison campus, established a 12-week family medical leave program costing $243 million, and created workforce education and grant programs.

The measure Republicans introduced in place of the plan would cut taxes from 5.3% to 4.4% for individuals earning between $27,630 and $304,170 and married couples earning between $18,420 and $405,550.

Passport

Passport

Follow Us