Evers signs Republican-authored bill to expand Wisconsin's state income tax credit for child care

Democratic Wisconsin Gov. Tony Evers has signed a Republican-authored bill that expands the state's child care state tax credit for claimants from 50% to 100% of their federal child care tax credit.

Associated Press

March 4, 2024

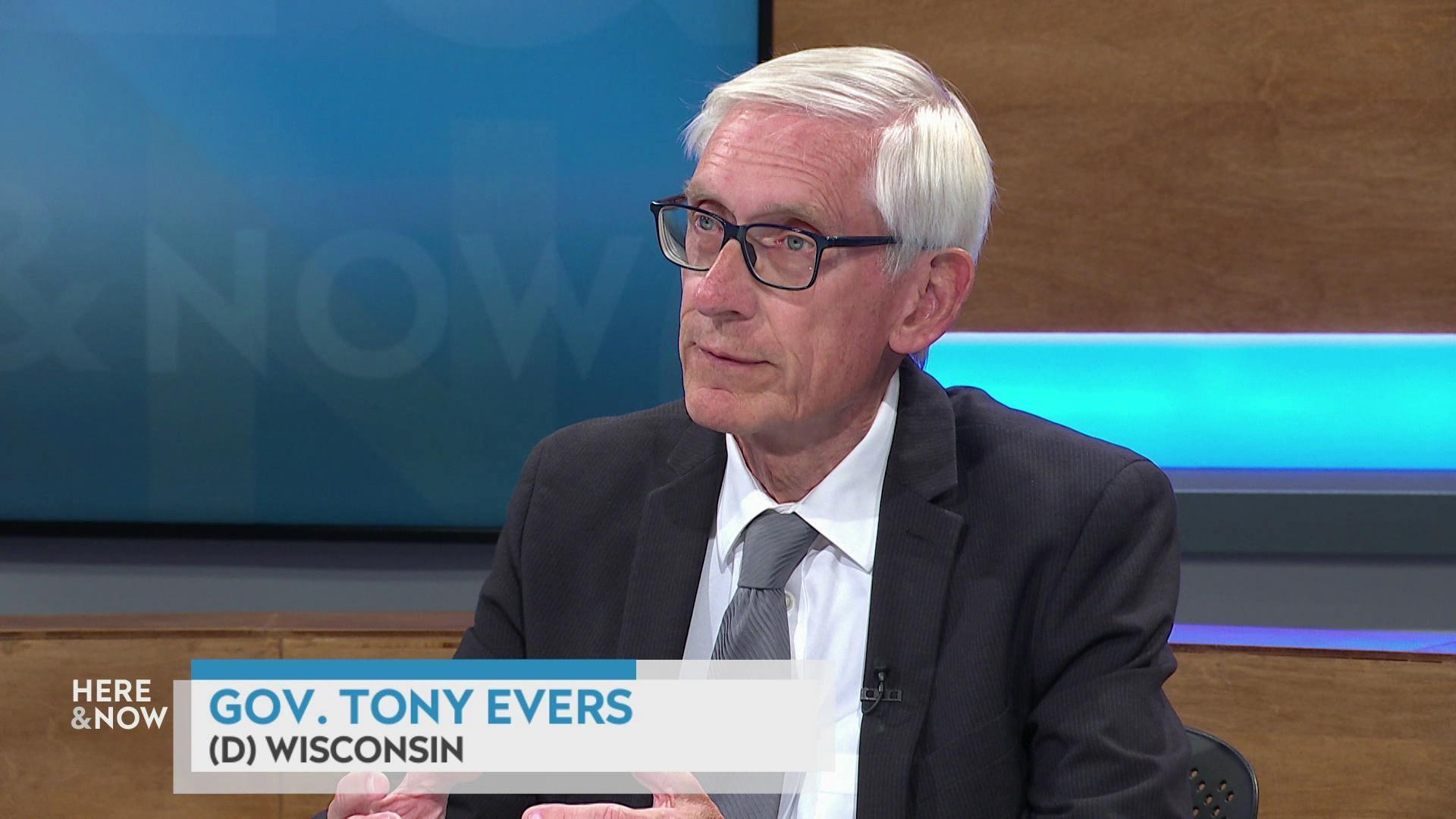

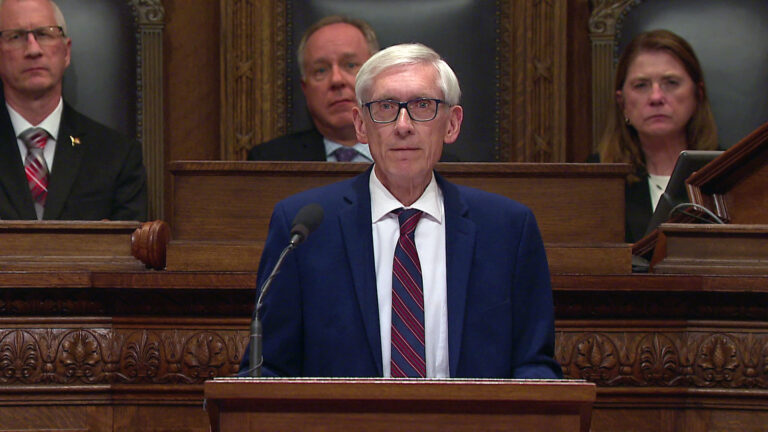

Democratic Gov. Tony Evers gives his annual State of the State address on Jan. 23, 2024, at the Wisconsin State Capitol in Madison. Evers signed a Republican-authored bill on March 4, 2024, that dramatically expands the state child care tax credit. (Credit: AP Photo / Morry Gash)

MADISON, Wis. (AP) — Democratic Gov. Tony Evers signed a Republican-authored bill on March 4 that dramatically expands the state child care tax credit, days after vetoing three other GOP bills that would have delivered $800 million in tax cuts.

The governor signed the bill at a charter school in Waukesha. He said in a statement that he approved the measure because “the cost of child care is too darn high.”

“Signing this bill today will go a long way toward defraying yearly family expenses on child care, giving Wisconsinites some breathing room in their household budgets and making sure our kids have the early support and care they need,” Evers said in the statement.

The median child care cost last year in Milwaukee County, the state’s most populous county, was $19,096, equivalent to about 26% of the median family income of $62,314, according to the U.S. Department of Labor. The cost last year in Dane County, the state’s second-most populous county, was $19,586, equivalent to about 17.6% of the $94,813 median family income.

The bill expands the state child care tax credit to 100% of the claimants’ federal child care tax credit. Currently filers can claim only 50% of the federal credit on state taxes. The amount of maximum eligible expenses under the state credit would grow from $3,000 to $10,000 for one qualifying dependent and from $6,000 to $20,000 for two or more dependents.

The move is expected to cost the state about $73 million in annual revenue, according to the state Department of Revenue.

The measure was part of a package of tax cuts Republicans introduced in January. The legislation included the child care tax credit expansion; a bill that would have expanded the state’s second income tax bracket to cover higher earners, resulting in at least $750 million in income tax savings annually, according to legislative fiscal analysts; a bill that would have increased the marriage tax credit; and a bill that would have increased income exemptions for retirees.

Fiscal analysts projected that taken together the four bills reduced state tax revenue by $2 billion in 2024-25 and about $1.4 billion every year thereafter.

Evers vetoed all the bills except the child care tax credit expansion on March 1, saying the cuts would drain the state’s reserves.

Evers vetoed a similar GOP tax cut plan in November. Republicans lumped all the proposals into a sweeping omnibus bill during that go-around. This time they broke the plans into separate legislation.

The governor also used his partial veto powers in July to reduce a $3.5 billion income tax cut plan the GOP included in the state budget to just $175 million, which equated to a $3- per-month reduction for the average taxpayer.

Passport

Passport

Follow Us