Turning Off The Budget Autopilot To Ease Household Finances

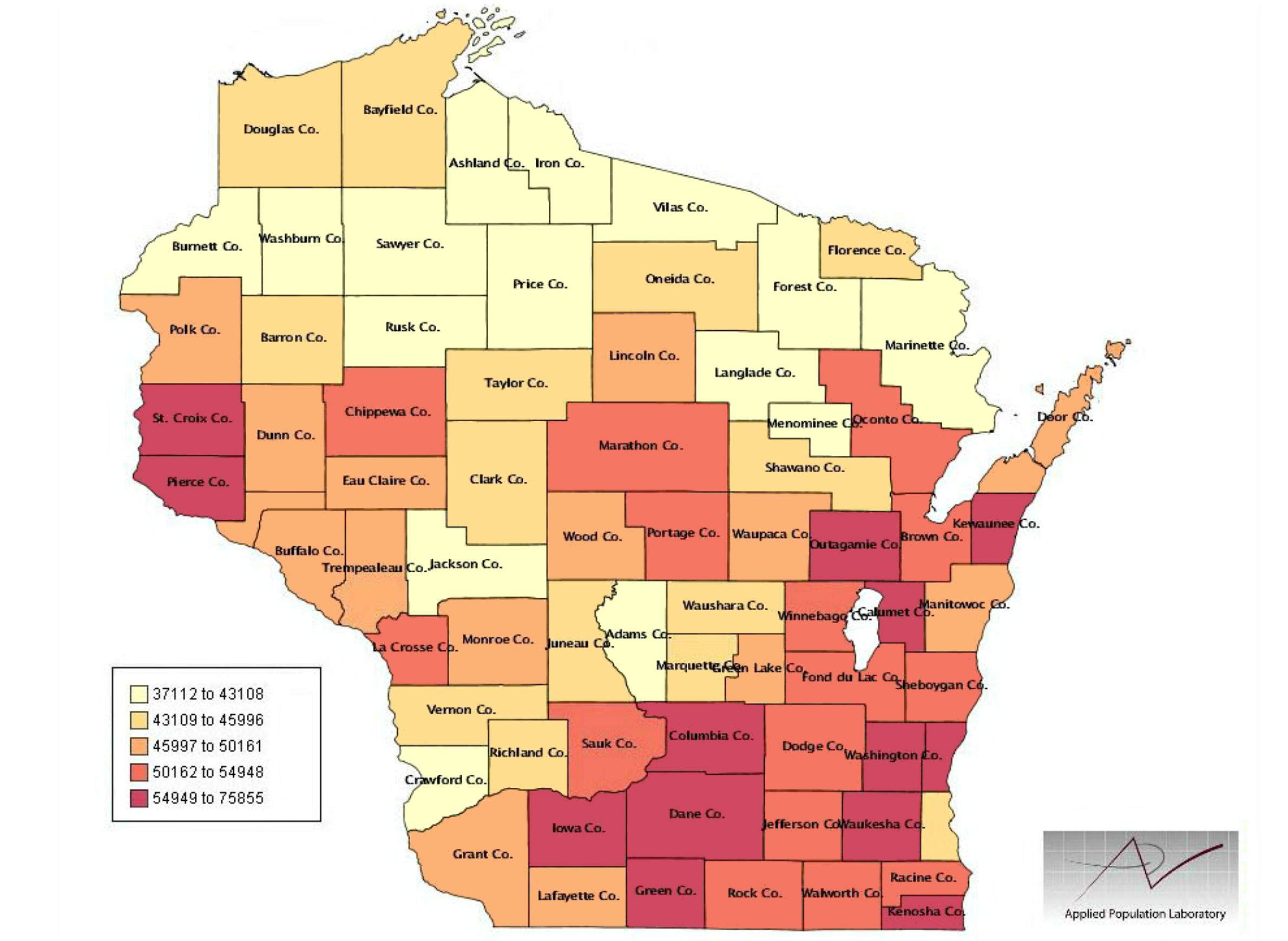

People who feel their paychecks are not keeping up with everyday expenses may be right — median household income is down for many families across Wisconsin.

June 21, 2016

Checkbook and pen

People who feel their paychecks are not keeping up with everyday expenses may be right — median household income is down for many families across Wisconsin.

From 2009 to 2014, all but two counties in Wisconsin — Adams and Florence — had stagnant or falling median household incomes. At the same time, household expenses continue to creep up each year, with annual inflation rates averaging around 1.6 percent over those years.

But despite any drop in income, most households have their spending on autopilot, buying the same groceries, eating at the same restaurants and putting gas in the car without a lot of long-term planning. If making ends meet is harder, or money is not getting set aside toward financial goals, the household budget may need a tune-up.

The first step is knowing how much money is coming into the household. To determine net income, look at the money left in a paycheck after taxes, insurance and other deductions are taken out. Use any regular sources of income as the benchmark for how much is left to work with each month.

Occasional sources of income, including tips, gifts, commissions, or side jobs also should be added up. Windfalls, like a tax return or gift, are a great way to boost savings or pay down a debt more quickly, but these irregular sources of income should not be counted on as a way to balance monthly spending.

The second step is to track spending for one month — the specifics of what is actually spent, not just estimations. Many ways exist for tracking expenses, from writing them down in a notebook to saving receipts to taking advantage of useful websites and apps (such as Mint.com). One month provides an opportunity to look at regularly occurring expenses, such as rent or mortgage, car payment or other transportation costs, student loans, utilities, and credit cards. These regular, or fixed, expenses are usually easier to plan for and to keep track of, but they are also the biggest chunk of a household’s spending.

Harder to track are things like daily spending at the grocery store when picking up a few items or giving the kids cash for a school event. Every household has these flexible expenses each month, but some are more expensive than others. A balanced spending plan allows for flexibility so that when the price of gas goes up or a birthday present needs to be bought, ways can be found to cut spending that month.

Every household also needs a way to track of irregular expenses. These non-monthly expenses might include auto insurance that is due quarterly, an annual car registration or an unexpected trip to the doctor. Some households set aside a little money toward irregular expenses and financial goals each month, while others cut back on spending the month a big payment comes due.

Sometimes keeping up with a household spending plan is a matter of paying bills on time to avoid late fees or balancing a bank account regularly to avoid overdrafts and to account for fees. Setting a regular date and time for paying bills and a specific place for sorting and filing paperwork will make life a whole lot easier.

Just the act of tracking spending can be very eye opening. It’s easy to start noticing spending leaks and habits that might not have been otherwise noticed. (The bottom line for me is always whether you are happy with where you’re spending your money and how it’s working for you.)

After tracking spending for one month and planning for irregular expenses, the final step is to compare total spending to income. If the household spends less than it brings in each month, discovery of the difference is a great opportunity to revisit savings and financial goals. Having this unspent income directly deposited into a savings account is an excellent way to set aside emergency funds or retirement savings without being tempted to spend the money first.

It is not unusual for household spending to be greater than income a few months out of the year. However, if monthly spending outpaces income every month, problems keeping up with payments or getting buried in debt may arise. A solution might be as simple as a few cuts to spending, especially little habits like buying snacks from a vending machine that can be stopped and not missed. A bigger shortfall in income could require a bigger lifestyle change, whether cutting down on daily spending or looking for ways to increase monthly income.

Setting priorities for spending is an essential step in balancing a household budget — especially when less money is available. University of Wisconsin-Extension offers tips and worksheets on managing personal finances in tough times, and local Extension offices can provide additional information about financial management programs and services.

Peggy Olive is a senior outreach specialist with University of Wisconsin-Extension Family Living Programs and UW-Madison Center for Financial Security.

Passport

Passport

Follow Us