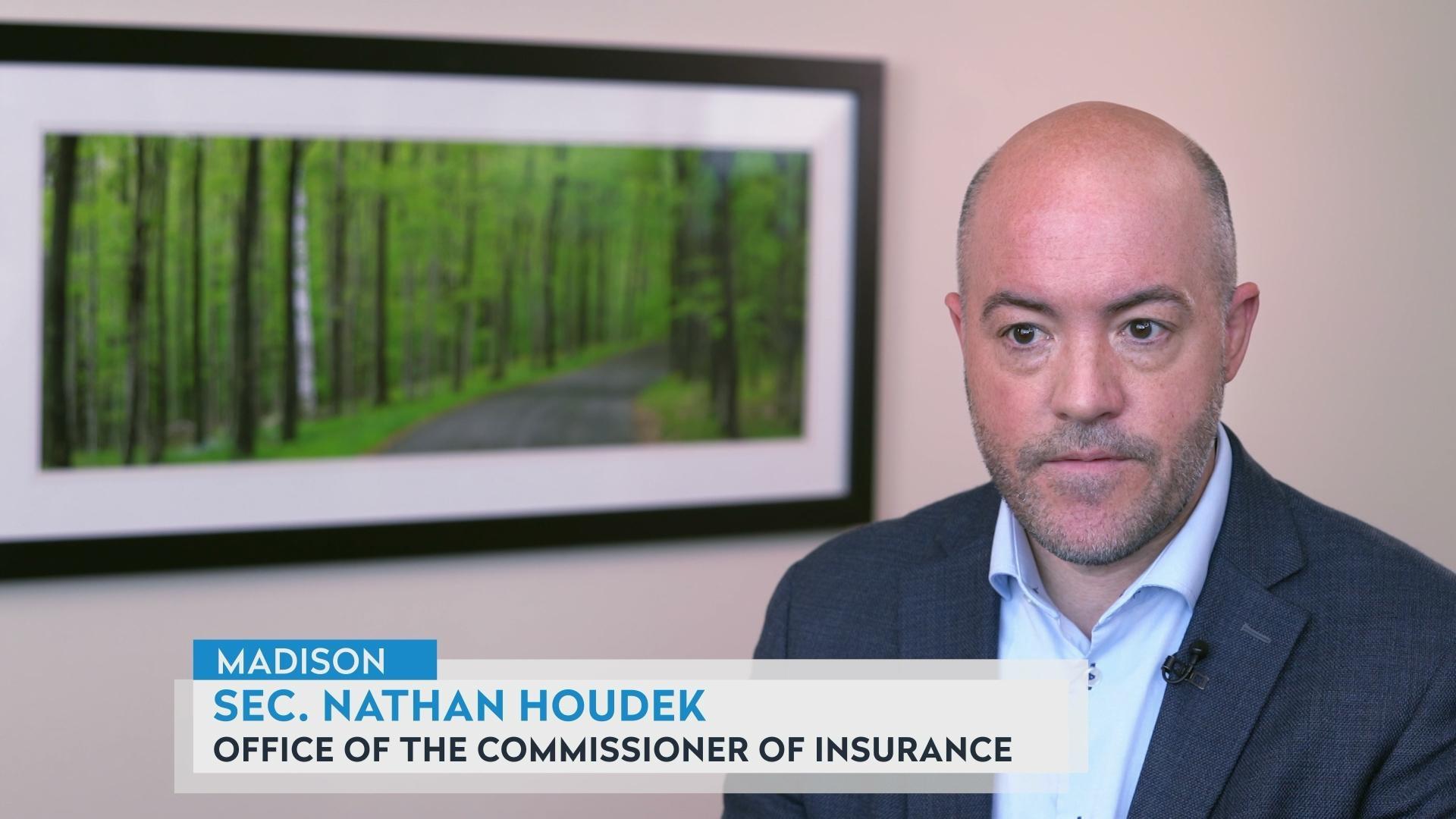

Sec. Nathan Houdek on consumer confusion about health plans

Wisconsin Office of the Commissioner of Insurance Secretary Nathan Houdek discusses the complicated differences between fully insured health coverage and self-funded plans provided through employers.

By Marisa Wojcik | Here & Now

August 12, 2025

Nathan Houdek on differences between fully insured health coverage and self-funded plans.

VIDEO TRANSCRIPT

Sec. Nathan Houdek:

There's a lot of consumer confusion, and the system is, you know, admittedly very complicated. And you know, if you have your health care coverage through your employer, if you're fully insured, you would have an insurance card, and it's the insurance company that essentially bears the risk for paying for health care-related claims. If your employer self-funds that coverage, they usually still contract with an insurance company, or what's called a third-party administrator, and oftentimes, as an employee, you still receive a card from the insurance company that is serving as that third-party administrator. From the employee experience, you're still paying premium and you have cost sharing, and really, it looks the same whether you have fully insured coverage or self-funded. And again, you know, you have that card that can be from an insurance company either way. So you really don't know. And it's important for individuals who have coverage through their employer to really understand that difference, to really understand, is this fully insured coverage or is this self-funded coverage? Because the way those two types of coverage are regulated are very different. There are resources out there for people to turn if you do get your insurance through your employer, whether it's fully insured or self-funded. Your employer can provide information about your benefit design and the types of prescription drugs that are covered — the formulary — so that would be the first place to go in terms of getting information. If you do have an interaction or if you do have an issue with an insurance company, you feel that a claim is being improperly denied or a service is not being covered, you can contact our office. And we encourage people to contact our office to help resolve those claim and coverage disputes. Our consumer affairs team, which is our team that, really the experts that help people if they have questions or any problems with their health insurance company. So, our consumer affairs team provide assistance to over 1,600 people who called our office with issues with their health insurance. Now, the challenge is that about a quarter of those — a little over 400 — were self-funded coverage. We did help those people make contact with the Department of Labor and get the assistance that they need. But ultimately, that's outside of our regulatory jurisdiction. So we don't know how those issues or disputes are ultimately resolved.

Passport

Passport

Follow Us