Frederica Freyberg:

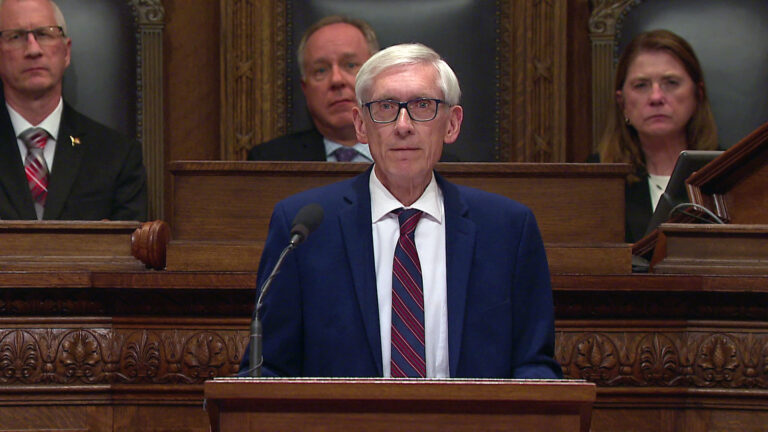

A first look tonight at the tax cut plan passed by Congress and signed by the president this week. Surrounded by fellow Republicans and President Trump at the White House, House Speaker Paul Ryan said the plan sends a strong message to Americans.

Paul Ryan:

It is really simple. The message to the hard-working taxpayers of America is your tax relief is on its way. That is what’s happening here. The message to the families in America who have been struggling paycheck and paycheck, your tax rates are going down and your paychecks are going up. This is the kind of relief that Americans deserve. This is the kind of tax reform and tax cuts that get our economy growing to reach its potential. This gets us better wages, bigger paychecks, a simpler tax system. This gets the American economy competitive in the global economy.

Frederica Freyberg:

House Speaker Paul Ryan on the passage of the tax cut package. On the other side of the aisle, U.S. Senator Tammy Baldwin had this to say. “This is largely a tax giveaway to the wealthiest few, big corporations and Wall Street while millions of middle class families will face tax hikes. Powerful corporations get permanent tax breaks. The top 1% will see 83% of the benefits and Republicans have put people’s health care on the chopping block to pay for it. That’s just not right and it’s not fair. We should have worked together on bipartisan reform that was focused on the middle class.” So those are the political persuasions around the tax cuts and changes passed this week in Washington. But what does it mean on the ground here in Wisconsin when you sit down to file your taxes? We turned to Todd Berry, President of the Wisconsin Taxpayers Alliance. Thank you very much for being here.

Todd Berry:

Good to be back.

Frederica Freyberg:

So the $10,000 deduction cap for state and local taxes, will that hurt the majority of Wisconsin tax filers?

Todd Berry:

No, in short. The average Wisconsinite maybe pays $2500 to $3,000 in income taxes. Property taxes, maybe $3,000 or something like that. You know, home values are not high in most of Wisconsin. So when you put that together, the average will be well below the cap. Where things are going to get interesting is not in the middle. It’s going to be in the upper middle. It’s going to be in the $150,000 range, $200 range, where you may have a fair amount of income, state income taxes and a larger house and live in an expensive community.

Frederica Freyberg:

As for the kind of new tax brackets, people who might experience a cut, would they start seeing those out of their paychecks right away?

Todd Berry:

Well, it depends on when they change the withholding tables and that will mean the IRS will have to talk to employers, et cetera. But they should see it early in the year.

Frederica Freyberg:

Now, you say that far fewer people will end up itemizing because the standard deduction nearly doubles, $12,000 for a single filer, $24,000 for married. How many fewer?

Todd Berry:

Right now something like 1/3 of Wisconsinites itemize, give or take. After this, I think it will be more like one in ten. I mean, that’s a little bit of a guess. But — and from my perspective, being an old tax guy, to allow tax preparation and filing to be easier is a good thing. We make it way too hard.

Frederica Freyberg:

Well, that is good, because one of the things they wanted to do was simplify it.

Todd Berry:

Yeah. And it’s not — there is some step in that direction.

Frederica Freyberg:

So we’ve said that this salt cap won’t affect most Wisconsinites, but with the standard deduction now doubling, you’re saying 2/3 of people in Wisconsin probably won’t itemize or more. But you also say that that could mean these people would see a state tax increase.

Todd Berry:

Yeah. I don’t mean to exaggerate here, but if you’re not itemizing at the federal level and so you’re going to become a standard deduction taker, you don’t carry over your itemized deductions to the Wisconsin return, then you may need a little bump in the state standard deduction in order to avoid problems. Now, I — you know, there will be some kind of state adjustment, rate reduction, and there really probably should be some sort of standard deduction increase as well. I’m not saying this is going to be widespread. You get up into this $100,000-$150,000 range it gets interesting.

Frederica Freyberg:

What do you make of the corporate cuts being permanent but the individual cuts sunsetting?

Todd Berry:

Well, I mean the real reason for that is simply the way the procedure was set up and certain debt rules and so forth. I think in reality both are permanent, one for legislative reasons, one for political reasons. Congress doesn’t undo tax cuts usually.

Frederica Freyberg:

That would be difficult. But do you expect businesses to give higher wages or hire more people given their windfall?

Todd Berry:

Well, this is going to be the big debate. Economic theory suggests that, you know, businesses pass on taxes to workers or consumers or perhaps shareholders, so, you know, that would suggest that some of the benefits would shift to people and there is some indication in the early news that there are bonuses happening, an announcement of some kind of investment activity. But we’ll have to see.

Frederica Freyberg:

Todd, we do not to let you go without recognizing that you are retiring from the Wisconsin Taxpayers Alliance as its president after how many years?

Todd Berry:

Almost 25.

Frederica Freyberg:

So you’re moving on to do what?

Todd Berry:

Well, I am an avid painter as a hobby. I’m an avid gardener. I collect learning foreign languages. I have kids and my wife prays for grandkids, so we’ll be busy.

Frederica Freyberg:

You have also been on Wisconsin Public Television for just about as many years. So thank you very much.

Todd Berry:

It's been a pleasure. I always hear good things from your listeners.

Frederica Freyberg:

Todd Berry, congrats.

Search Episodes

News Stories from PBS Wisconsin

Donate to sign up. Activate and sign in to Passport. It's that easy to help PBS Wisconsin serve your community through media that educates, inspires, and entertains.

Make your membership gift today

Only for new users: Activate Passport using your code or email address

Already a member?

Look up my account

Need some help? Go to FAQ or visit PBS Passport Help

Need help accessing PBS Wisconsin anywhere?

Online Access | Platform & Device Access | Cable or Satellite Access | Over-The-Air Access

Visit Access Guide

Need help accessing PBS Wisconsin anywhere?

Visit Our

Live TV Access Guide

Online AccessPlatform & Device Access

Cable or Satellite Access

Over-The-Air Access

Visit Access Guide

Passport

Passport

Follow Us