Frederica Freyberg:

Across the state, Republicans announce their proposal for a significant bump in shared revenue, the amount of money the state distributes to local governments which hasn’t seen increases in nearly two decades. Compounded with limits on how much local governments can raise taxes, Wisconsin communities have been strapped. One mayor recalled, “I will never forget the year that we considered shutting off every other streetlight in the city of Watertown to save $250,000.” In Milwaukee, Assembly Speaker Robin Vos gave the broad strokes of the plan as well as the city mayor.

Robin Vos:

One of the things we’ve also heard from our local partners is they need to have an ongoing revenue source that is not stagnant but grows as the economy grows. This fund actually will take the increase in sales tax over time. It’ll be run through a formula where there are different buckets and each of those buckets will grow as the sales tax and our economy continues to expand. We also focused on putting money into helping local governments change how they operate. In addition to the almost $225 million that will be invested in shared revenue increase payments, we are also creating something called the Innovation Fund. It means that there will be $300 million allowed for local governments who choose, entirely voluntary, to cooperate with each other, to share services, improve the delivery that we give to our constituents, hopefully all at a lower price.

Cavalier Johnson:

I’m pleased though that we’ve made some significant strides towards a remedy to the city’s fiscal issues. From the outset, that’s been paramount, a paramount goal of mine, and this legislation starts to diversify revenue sources for the city of Milwaukee. It starts to increase the amount of shared revenue that goes to the city of Milwaukee and other units of government across the state. It puts Milwaukee on a path to resolve its onerous pension obligations.

Frederica Freyberg:

Under the plan, 20% of the state’s sales tax will go toward increasing local government funding. According to authors of the proposal, this will mean a roughly $500 million increase statewide and every community will see an increase of at least 10%. Speaker Vos appointed member of the Joint Finance Committee Republican Representative Tony Kurtz to come up with a plan and he joins us now. Thanks very much for being here.

Tony Kurtz:

My pleasure.

Frederica Freyberg:

Describe how needed this boost to local government is.

Tony Kurtz:

Well, the original shared revenue formula was actually frozen back in 2004 and some communities in my beautiful district have told me they’ve actually lost money over the years obviously due to inflationary pressures, and so I think it’s long overdue. I know you’ve had comments from Speaker Vos about this has been long overdue, and I think it’s the right time, particularly with the inflationary pressures of so many small communities. Why I got involved is I have a very small rural community and they’ve suffered as well. In the original formula, formulated years ago, actually kind of hurt small communities and I know that’s one of the things we focused on with this package.

Frederica Freyberg:

So what areas were deemed priorities in the proposal where the money is restricted to for use?

Tony Kurtz:

Well, I think — I think about it, what — in those communities, what do they need? Obviously, cities, villages, they obviously have more law enforcement, EMS, those type of providers. In our counties, it’s highway departments, it’s sheriff departments, but in townships, it’s a lot more EMS-related and also roads. You hear that from all townships, especially town chairmen about the need to invest in roads. So we’ve kind of tailored this new money, the new $227 million that we’re going to put into towns, villages and cities and counties. We would like those areas targeted. Law enforcement, our fire departments, our EMS providers, you know, our dispatch, also public works and transportation, and I think, trust me, what I hear from my constituents and my local officials, they can definitely use that money in those areas. And one of the feedbacks I got today from somebody today, to be honest with you, they said I can only use this in my sheriff’s department. Well, that’s true, but now you can use this money to fund your sheriff’s department, which should, in turn, maybe free up money elsewhere that you can use throughout the county. So I think they can be creative, but our goal was to definitely support those key components of our locals.

Frederica Freyberg:

So is there any percentage of the money that is unrestricted?

Tony Kurtz:

Well, once again, everybody is going to their current new — their current amount of shared revenue, and like I mentioned before, and like you said earlier, everybody is going to see at least a 10% increase. A lot of communities, particularly some of our smaller cities, villages and townships, they’re going to see a much larger increase. And so obviously with that increase, they’ll be able to use that money for the needs that they have in their individual communities.

Frederica Freyberg:

The plan also calls — or allows the city of Milwaukee to impose a new local 2% sales tax if voters agree. But again, restricts some of how it can be spent. Like, for example, no money toward street cars. Why is that provision in there?

Tony Kurtz:

Well, let’s talk a little bit about Milwaukee. Milwaukee and the mayor, and I give the mayor a lot of credit, he has been at the table. He has been very helpful and it’s been refreshing to work with him, to be very honest with him, and also the county executive, David Crowley, who I would consider a good friend of mine. I think it’s been very refreshing to work with both of them. But the city particularly is in financial stress. I mean, we’re not talking about do they — if they would need to declare bankruptcy, it’s a matter of when they would need to declare bankruptcy. So I think our position is if you’re in such dire straits financially, which they are, maybe you just need to focus those — that money in areas that you truly need it. Now, one of the things that’s not getting told is we’re not saying you can’t fund that streetcar. You just can’t use this money. You can still get federal grants. You can still get private donors. There’s still ways to fund that, especially the city of Milwaukee, they’re very creative. Mayor cavalier, I think is very resourceful, and I think in the end, he wants to get that streetcar funded, I think he can find a way to do that.

Frederica Freyberg:

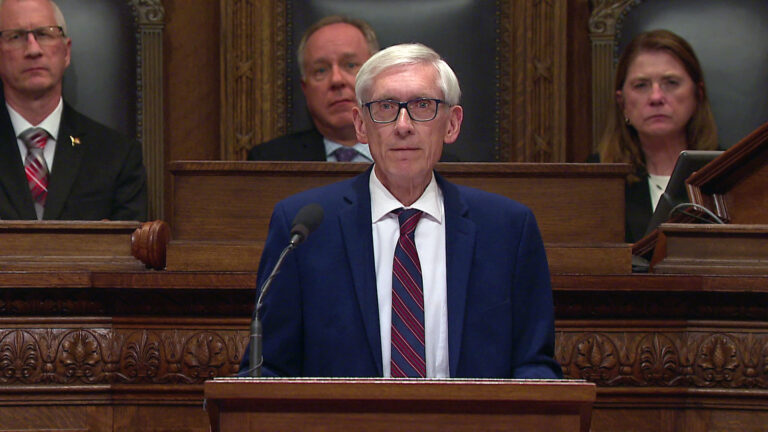

Just very quickly, this is a bipartisan effort. Did you work with Governor Tony Evers on this, whose plan that he announced in the budget mirrored the 20% of state sales tax?

Tony Kurtz:

Well, the speaker and the majority leader actually on Wednesday evening, met with the governor, and I perceived many more meetings in the future and, like I said a few minutes ago, David Crowley, the mayor, I mean, we’ve met quite a bit over the last six months on this issue, and I give them a lot of credit. My counterpart on Joint Finance Committee, Evan Goyke, a Democrat from Milwaukee, he and I have talked about this. He’s been in the room for the last month. We do want this to be a bipartisan bill. We want buy-in. I think that’s why we brought them early on into the process. And the last month, we’ve had some very good discussions. Some back and forth, and it’s been very healthy, very respectful. Personally, I’m very proud of what we’ve done. We’ve got a little bit more work to do, to be fair, but I think we’re in a good spot, and I think for my area, this is a wonderful package that will definitely help rural Wisconsin.

Frederica Freyberg:

That’s great news. Republican Representative Tony Kurtz, thanks very much.

Tony Kurtz:

Thank you for having me. Appreciate it.

Search Episodes

News Stories from PBS Wisconsin

Donate to sign up. Activate and sign in to Passport. It's that easy to help PBS Wisconsin serve your community through media that educates, inspires, and entertains.

Make your membership gift today

Only for new users: Activate Passport using your code or email address

Already a member?

Look up my account

Need some help? Go to FAQ or visit PBS Passport Help

Need help accessing PBS Wisconsin anywhere?

Online Access | Platform & Device Access | Cable or Satellite Access | Over-The-Air Access

Visit Access Guide

Need help accessing PBS Wisconsin anywhere?

Visit Our

Live TV Access Guide

Online AccessPlatform & Device Access

Cable or Satellite Access

Over-The-Air Access

Visit Access Guide

Passport

Passport

Follow Us